Overall, the construction industry is facing a lot of pent up demand that will translate into constant growth for the next three years, said Dave Zwicke, market intelligence director and senior regional economist for the Portland Cement Association (PCA).

Zwicke gave his forecast at the recent AED/Infor Executive Forum held Sept. 18-19 in Rosemont, IL. As Senior Regional Economist, Zwicke tracks and forecasts U.S. regional and state cement demand, construction trends and market conditions.

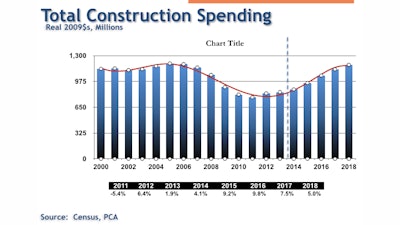

Zwicke noted that the past recession was the worst economic downturn since the great depression with 8.5 million jobs lost, a 38% decline in construction activity and 73% decline in housing starts. Since 2010, however, there has been slow, but steady, growth in both employment numbers and GDP. While flatter, construction spending has also had grown upwards since its bottom in 2011.

"The recession was so harsh, that expectation for future growth has been distorted," he said. "We might have a prolonged period of 2% growth as the 'new normal.' Our industry is cyclical, and we can't dismiss that."

Zwicke noted cement intensities signal broader activity in the concrete market. "Intensitities rise and fall based on a number of factors," he says. "Including geographic trends, building preferences, sector strength and cyclical patterns. The sustained rise in recent months of cement intensities signals an apparent cyclical turning point. New projects entering the pipeline are a catalyist for these sharp intensities rises."

Housing sales are in a transitional period. Sales activity has less support than in previous years from the number of distressed properties. "Sales activity in this area is not supported by discounted properties," said Zwicke. "The focus is now on more basic fundamentals of demand, such as affordability."

Affordability remains very favorable from a historical point of view, while lending standards remain tight but are slowly easing. "As the economy firms and lending risks decline, PCA expects this to materialize in the lending standards," said Zwicke. "There is a risk - if there is no easing on lending standards, the sales pace we envision could be threatened."

Fewer distressed properties means an improved competitive position for new homes, with total sales increasing over the next four years. "There may be a constraint on the housing starts projection," said Zwicke. "Labor shortages and property availability are assumed to be temporary and will be fixed by the market."

The housing starts mix remains trending toward multifamily units.

Nonresidential construction spending is also on a steady increase. Public utility construction is expected to continue benefitting from domestic energy exploration as it share of commerical construction grows to 43%. The others in the commercial mix include industrial construction (9%), office (25%), retail (17%) and hotels/motels (6%).

Public construction is looking to be flat or even slightly down over the next several years. While state/local fiscal problems are starting to fade, 93% of public construction is performed at the state/local level. As revenue growth improves with economy and job growth, surpluses will re-emerge and pent-up demand will be released. "Public construction has reached the trough," says Zwicke. "Growth in this area is led by improving conditions at state and local governments."

Highway spending will remain flat. The federal government, rather than funding states, may switch to an infrastructure bank type system. "There is a fear that there may be a 'devolution'-type bill put before Congress," said Zwicke. "This type of bill would stop funding states by suspending the federal gas tax. Some states, like Montana, with many roads and few people, would lose out, while other states with smaller road systems and higher population numbers, may actually benefit. But make no mistake, this would be a step backward."

In summary, said Zwicke, "With a resurgence in public spending, a residential catalyst for growth, and a healing of state deficits, there will be an acceleration in construction spending next year. Our industry is cyclical and there's a lot of pent-up demand, so there will be constant growth for the next three years going forward."