Here is the history of Pavement Repair-only sales:

2022 - $247,572,610 (list size 50 companies)

2021 – $205,407,647 (list size 75 companies)

2020 – $217 million (50)

2019 – $209 million (50)

2018 – $265 million (75)

2017 – $165 million in sales (50)

2016 – $255 million in sales (75)

As with all the other lists (paving, sealcoating and striping) the total revenue in this segment is way up compared to last year - again with 25 less companies to comprise the total. The pavement repair segment did not increase as drastically as the others. This might be because customers had pent up demand for larger projects and the repair money went into the paving bucket.

See who made the 2022 Pavement Repair Top 5o List here.

Total Sales for the Pavement Repair 50

Total sales for all the work the Pavement Repair 50 did was $1,221,076,857. Higher than the $1.045 billion last year and lower than$1.360 billion in 2020.

As a percentage of total sales by the Pavement Repair 50, pavement repair-only sales accounted for 19% total work completed by the contractors, which is the same

It makes sense that the percentage of pavement repair completed is the same this year as contractors were most likely focused on larger projects that were not let during 2020, the year of COVID.

Contractors in the Pavement Repair 50 perform other work as follows:

- 46 perform paving work

- 44 perform sealcoating work

- 42 contractors perform striping work, although in very small percentages

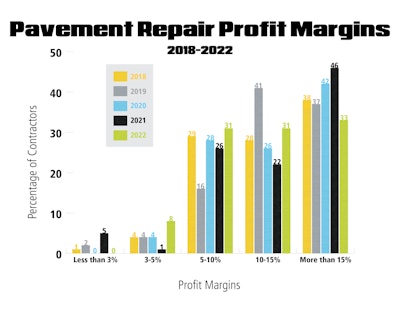

Profit Margins

Profit margins for the 2022 Pavement Repair 50 decreased quite a bit this year for the same reasons listed above. However, we did see an increase in the more than middle range profit margin segment, which isn't all bad.

- 33% reported margins of more than 15%, down from 46% last year

- 31% reported margins in the 10-15% range, up from 22% last year

- 31% of contractors in the Pavement Repair 50 also reported margins in the middle 5-10% range, a bit more from 26% last year

- 8% reported margins of 3-5% , up from 1% last year

- 0% reported margins less than 3% down from 5% last year

Where the Pavement Repair 50 Contractors Work

All of the Pavement Repair 50 indicated they generate sales from parking lot work, with six companies generating 100% of their sales from parking lots and another 10 reporting 90% or more of sales from parking lots.

Possibly demonstrating the impact large paving companies are having on the list, roads/streets and highways make up a decent percentage of work completed. Ten companies (20%) are reporting sales from highway work and 37 companies (74%) report sales from streets and roads (up from 64% of companies last year).

Their Customers

- All 50 contractors work for commercial/industrial customers

- 43 contractors work for multi-family residential customers

- 36 contractors work for municipal clients

- 23 contractors work for single-family homeowners, but in very small percentages

Replacing the Pavement Repair 50s’ Equipment

Three companies reported it would cost less than $500,000 to replace their equipment. Another five reported it would cost $500,000-$1 million to replace their fleet; 14 companies said it would cost $1-$2 million; and 28 companies reported it would cost more than $2 million to replace their equipment.