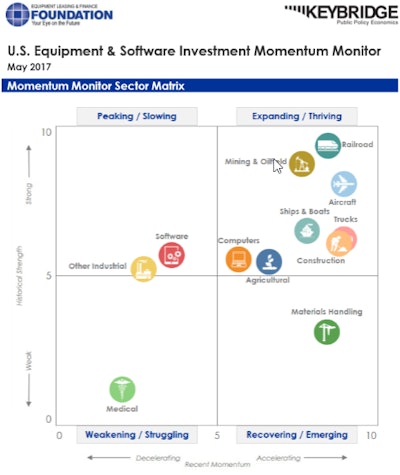

According to the Equipment Leasing & Finance Foundation (Foundation) Q2 Equipment Leasing & Finance Economic Outlook Report, elevated business confidence will boost growth and equipment and software investment will expand by 2.8% in 2017 in most verticals.

Ralph Petta, President of the Foundation, said, “Our forecast for an improving equipment finance sector is based largely on actions coming out of Washington that indicate a more business-friendly approach by the new Trump Administration, the recent move by the Fed to gradually increase short-term interest rates, and early indications of a steadily growing economy. It is our hope that these factors do in fact provide impetus for the equipment finance industry this year to outperform 2016.”

The report also notes that in particular, construction machinery investment growth is likely to accelerate over the next three to six months. If you've decided you need to replace or upgrade any equipment this year, the next consideration is whether to purchase it directly, to secure financing so your cash flow isn't affected, or take out a lease. Knowing your options can help you make an informed choice.

Equipment Leasing

Leasing can be a great solution for businesses without the capital to make a purchase, allowing you to preserve cash while acquiring assets that will help your business grow.

You'll need to determine the minimum lease periods of any equipment under consideration. Consider your business and cash flow projections in relation to these minimum lease periods. If you purchase equipment with a minimum lease period of 3-5 years, you'll need to be sure you're not paying for something that you'll want to replace after 2 years.

Pros: Leasing equipment preserves capital, you don’t pay for maintenance and it’s often 100% tax deductible under the 179 IRS Tax Code.

Cons: You will usually pay higher costs over time than you would if you paid up-front because of compounding interest.

Bank Loans

Traditional bank loans offer long terms with fixed payment terms and some of the lowest interest rates available. Banks also require strong personal and/or business credit scores, a personal guarantee, collateral, and solid 3 year financials.

Pros: Banks are a good fit if you don’t need the money immediately.

Cons: Applying takes considerable effort and time – about one to three months. It can also be difficult to acquire these loans, as only 30% of small business owners who apply are approved.

Small business line of credit

This type of loan establishes a maximum loan balance for the business owner. This arrangement allows the borrower to draw and repay on the funds as long as they don’t exceed the maximum allowed amount. In this type of arrangement, you only pay interest on the amount used and collateral is usually not required. Day to day costs, meeting payroll and surprise expenses makes this a flexible option.

Pros: It’s quick access to money with small payments and it can build your business credit score if you make the payments on time.

Cons: A personal guarantee is required and it is tied to personal credit. This also hinders your ability to borrow from other lenders. Interest accrues quickly if balances aren’t paid on time and there are initial up-front fees to obtain the line.

Business Credit Card

These cards are designed for business owners. They provide a revolving line of credit with a set limit in order to make purchases and withdraw cash. A small business credit card carries an interest charge if the balance is not repaid in full each billing cycle. You may be able to get one through your bank.

Pros: It’s a convenient piece a plastic you can carry around with you for day to day purchases.

Cons: There are annual fees, cash transfer fees and balance transfer fees. The interest rates are high on unsecured debt. Interest compounds rapidly every day and because payments are very minimal, it can create debt that is overbearing on businesses. These are not designed to finance business, just to be used for small day to day purchases.

Alternative Loans

The majority of small to medium-sized business aren’t bankable for one reason or another. Alternative lenders have filled the financing gap for many of them. They evaluate the cash flow, growth potential and overall strength of the business and as result, alternative loan options have much higher approval rates. Typical arrangements are:

- Small Business/Working Capital Loans – These are usually more flexible than banks when it comes to loan approval and repayment schedules and provide cash much quicker than traditional banks can. Usually no collateral is required to apply.

- Merchant Cash Advance -This is technically not a loan, but an advanced based lump sum of money. The funds are usually dispersed quicker than other traditional loans. Payment amounts will fluctuate depending on sales.

Pros: It’s an easy approval, quick access to cash with no collateral required. Programs are designed on an individual basis with no effect on personal credit. You can also re-up at the mid payment point.

Cons: Generally lenders aren’t open to long-term financing, with terms no longer than 12-15 months. They also lend in much lower dollar amounts than other types of financing.

(Another alternative option is microloans for Small Businesses...)

SBA Business Loans

The Small Business Administration (SBA) offers a variety of loan programs for very specific purposes, here’s two viable choices:

- General Small Business Loans - The 7(a) Loan Program is SBA’s most common loan program. Key factors of eligibility are based on what the business does to receive its income, the character of its ownership and where the business operates.

- Real Estate & Equipment Loans: CDC/504 - This program provides financing for major fixed assets such as equipment or real estate.

Pros: They are cheap with minimal payments. Borrowers are able to provide a lower up-front equity injection and get much longer loan terms and pay off schedules, in comparison with conventional commercial loans.

Cons: There is less than a 20% approval rating and can take up to 6 months to apply and be approved. Limits are capped by credit and business income and it hinders your ability to borrow from other lenders simultaneously.

Adam Stettner, CEO of Reliant Funding

Adam Stettner, CEO of Reliant Funding