New GAAP accounting rules for leases will be upon us in 2019 for public companies and all others in 2020. Since most of your companies are non-public, you’re probably asking, “Why is he bringing this up now?” Let me tell you why.

Every lease on your books plus any new leases entered into will have to be reviewed to determine if they are a “finance lease” or “operating lease.” If they fall into either category, they will be recorded on your balance sheets as both an asset and a liability and removed from your income statement as a lease expense. There is also a third category where short-term rentals or leases can continue to be accounted for as an expense.

Before we go any further let me define what “lease” means in this discussion: A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property, plant and equipment for a stated period of time in exchange for one or more payments. In addition, the arrangement is considered to give control over the use of an asset and the right to substantially all the economic benefits from using the asset, with the ability to direct the uses to which an asset is put.

A finance lease designation implies that the asset is being purchased (which may not be the case) because the lease terms and length use up a significant percentage of the asset’s useful life. This would be the case if:

- ownership shifts to the lessee at the end of the lease term ($1.00 buyout);

- the lessee has a purchase option at a very attractive price and is almost sure to use it;

- the lease term uses up 75% of the useful life;

- the present value of all lease payments and lessee-guaranteed residual value equals the fair value of the asset (at inception of lease);

- the equipment is so specialized that the lessor has no other use for it during the lease term.

Operating leases are lease arrangements that do not meet the finance lease requirement, except for short-term (12 month or less) leases, which you can elect out of the new GAAP lease rules.

Why is the Financial Accounting Standards Board (FASB) implementing these changes? Because they want to level the playing field and have all parties on the same page for reporting to outside third parties.

Right now, you can have two separate companies that own the same assets. One reflects its production assets as being depreciated over their useful life, with a related note on the books where the proceeds of that note were used to purchase those assets. The other company has the same production equipment provided by operating leases, which are reflected in the income statement as an expense with zero fixed assets or loans on the books. If you need to compare these two companies, you can do it but it takes a lot of work to make the two sets of books comparable.

Leased Equipment = Assets and Liabilities

Many if not most contractors have leased equipment in the form of vehicles, buildings, trucks, construction equipment and other items used in their daily activities. Some are finance leases (even though they may not realize it), some are operating leases and some are short-term leases related to rental company transactions.

The new rules convert 100% of the finance and operating leases into a format that takes the lease payments out of the income statement and places them as assets with the related purchase liability on your balance sheet. In short, it will look like the company purchased as opposed to leased the equipment.

So, in simple terms, if you lease a truck for $3,000 per month for 60 months, you made gross lease payments of $180,000. In year one, if the agreement was made on January 1, the lease expense is $36,000 on the books for each of the five years of the lease.

To convert this same lease to the new GAAP rules, the lease payments are removed from the income statement and instead booked as both a “right-to-use” asset for $180,000 and a liability (note payable) for $180,000. As the lease progresses through the lease term, you amortize the right-to-use asset and expense it and at the same time record the lease payment to reduce the lease liability account.

That is a simple example of how it works. But if you have a finance lease, there are more issues to deal with and the right-to-use is basically depreciated as if you purchased the equipment. On the other hand, operating leases are amortized on a straight-line basis like making a monthly lease payment.

So what happens once you capitalize your leases under the new rules? You increase the debt on your balance sheet — which is a big deal. Will the component changes impact your bank covenant results? Yes!

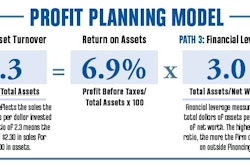

Leverage ratios will incur significant change. These are the long-term risk. This will impact the debt service ratio as well as debt/equity ratio (which is the problem).

Solvency ratios are impacted because you have now added another short-term liability for the current portion of the lease liability. Profitability ratios may be impacted, depending on the makeup of your lease portfolio.

Get an Early Start

Why am I bringing all of this up a year early? Because it gives you a year to get this under control. What you should do is:

- Assign someone to compile a file of all “lease” documents.

- Use the simple gross amount method to create the conversion numbers.

- Review all current agreements for terms, financial covenants and default language.

- Run the converted numbers and changes for 2017 and see where you stand.

- Determine what changes you can make to soften up the impact of the conversion.

- Figure out if you will have to find a new bank that is more receptive to the construction industry.

The point here is to see how your bank and other lenders will react to a set of financial statements with more debt. It’s better to project the changes for this year and then discuss the potential impact to see if they will have a problem with the lease adjustment or not. While I’m not suggesting you share your projected statements with your bank, if there appear to be problems, you may want to inquire how they might react should you have to book more debt on your balance sheet.

Keep in mind you aren’t actually adding more debt, just moving things around. Many bankers say they will ignore the adjustment. But who knows how their loan committee will react once they see the actual results of the change?

If you have any questions or need some help regarding the new lease accounting rules, don’t hesitate to contact me. If I can’t help you, I will find someone who can.

To that end, I have put together a list of construction industry experts who are available to assist you with just about any problem you encounter. I’ll share more about this next month.

Garry Bartecki is the managing member of GB Financial Services LLP and a consultant to the Associated Equipment Distributors. He can be reached at (708) 347-9109 or [email protected].