The U.S. construction industry is unprepared for the upcoming construction boom to eventuate over the next thirty years. Consider this: based on U.S. Census statistics for 2020, the nation continued a 40-year trend of seeing tens of millions of our citizens move from the North and Northeast to the South, Midwest and Southwest.

As a result of the Covid-19 pandemic, millions more moved to be closer to friends and family, in search of more affordable locations and housing with more living space, as well as warmer climates, as many can now work from anywhere in the nation. The net result of these geographical movements was an increase in the need for more homes, schools and healthcare facilities, accompanied by retail sales that eventuated in the need for more warehouses and industrial parks.

This massive shift in population must also be viewed in the context of our aging, built environment. Studies show that by 2050, commercial building floor-space is expected to reach 124.3 billion square feet, a 33% increase from 2020, with education, mercantile, office and warehouse/storage buildings making up 60% of total commercial floor space and 50% of all buildings. Meanwhile, 42% of our nation’s 617,000 bridges (46,154 bridges) are at least 50 years old and in dire need of major repair or replacement.

There is and will be, over the next 30 years, a massive need to repair and\or replace more than half of America’s existing building stock. These endeavors will reflect the growth of our population in existing urban areas, as well as in areas of the nation being newly developed as a result of our national migration trends of past decades.

This demand for construction work will also be supercharged by an influx of federal infrastructure funding, the initial $1.2 trillion funding of which has been authorized by the recent Biden administration. This new wave of investment will help support repair and replacement of work on our electrical grid, our roads and highways and support of superchargers for our growing electric car population, as well as $1 billion for renovations of our nation’s ailing airports.

In new, growing areas of our nation, we will see construction of massive new housing, office towers and educational and healthcare\research facilities, as well as repositioning old shopping malls and replacement of many our nation’s older educational and travel industry structures.

Residential Migration Patterns

Consistent with the previous decade, between 2018 and 2019, migration to the South and Southwest continued apace. The South had seven big cities among the top 15 with the largest numeric population change, including Phoenix, Charlotte, N.C. and in Texas: San Antonio, Austin and Fort Worth. This is consistent with the period from 2010 to 2019.

And yet, the global supply chain, interwoven with the construction and infrastructure markets, remains in a state of disruption and re-invention. If it wasn’t before, it has become painfully clear that we need to systemically overhaul our supply chain so that we do not get caught flat-footed again and are better prepared to handle the demands of the decades ahead — rather than continue to maintain a poorly-designed system of decades past.

Critical Elements

Given that so much of the global supply chain disruption was caused by effects of the pandemic — with no discernable action plan in place to handle it — the odds are small that we will experience any significant short-term rebound. However, even as we scrape along simply to function, longer-term, the AEC industry and its supply chain requires a multi-level transformation to meet the needs and challenges of the decades ahead:

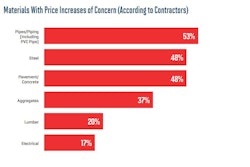

- Materials Costs: Total 12-month construction in the U.S. increased 11.2% to $1.7 trillion as of February 2022, according to the U.S. Census Bureau, with residential real estate contributing about half of the total. While residential grew by 16.5% year-over-year, commercial construction saw growth of 18%, recovering from a low base during 2020.

Meanwhile, new building prices have skyrocketed. According to the National Association of Home Builders, year-over-year lumber prices nearly tripled in Q1 2022, causing the price of an average new single-family home to rise by more than $18,600. This lumber price hike has also added nearly $7,300 to the market value of the average new multi-family building, which translates into households paying $67 a month more to rent a new apartment.

Framing lumber prices at the peak were adding $30,000 to the price of a new single-family house and $10,000 to a multi-family house, due to a pandemic-induced shortage of supplies. Lumber mills curtailed production in anticipation of slower demand in April 2020. Yet, even as demand held up better than predicted, mills did not immediately ramp up production, which has led to the current pricing challenges.

Aluminum and copper prices are stable right now, but they are at historically high levels. As the largest producer of raw aluminum, China has been curbing its manufacturing since 2020 to cut greenhouse gas emissions, resulting in lower supply amidst increasing demand, and thus increased prices.

Adding to costs, cement and concrete products have already seen a 3% increase in pricing from Q4 of 2021 to Q1 of 2022, with forecasts that those prices will climb another 7.7% by the end of this year. The good news is that these rising products and materials pricing will likely stabilize over the next year.

- Domestic Manufacturing: Currently, some 30% of building materials are sourced from overseas. We must reduce that number substantially to minimize reliance on what have become unreliable sources. That said, while many manufacturers are starting to bring their production facilities back to the U.S., it will likely be three to five years before we will experience a meaningful, collective impact from this domestic manufacturing rebound.

- Construction Technology: Technology must be introduced that enables reliable tracking of all construction products — dry wall, doorknobs, window panes, etc. — throughout their life cycle, from the time each is sourced from the manufacturer, shipped from its original location, and delivered to a project site for installation. Today, this process is fragmented and cannot be reliably traced, such that we are unable to consistently identify specific supply chain disruptions and how best to resolve those problems. Adoption and implementation of new construction technologies promise to bring about a sea-change in how projects are planned, executed, and completed.

- Trucker Conundrum: The construction industry labor shortage is being exacerbated by competitive wages offered in other industries. Walmart is reportedly offering up to $110,00 annually for full-time drivers and will continue to get more competitive as big retailers gear up for back-to-school and holiday shopping demands.

The trucker shortage cannot be addressed by higher wages alone. Truck drivers face a disruptive lifestyle — traveling long distances with long hours, truck-stop meals, and layovers, etc. — one that motivates many laborers to find work in other industries. Eventually, driverless trucks and/or breaking long routes into shorter ones may become an industry savior.

The U.S. construction and infrastructure sectors are facing an unprecedented challenge — and are presented with a once-in-a-century opportunity. As painful as the pandemic has been, the effects should have stripped away any illusions that our system, as currently constituted, is even remotely sufficient to meet these objectives in the decades ahead.

We have the collective knowledge and know-how to make changes that will materially improve the nation and how it functions. The industry must now show both the will and the commitment to make them a reality.