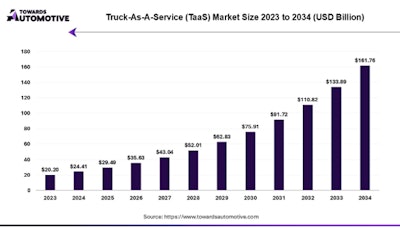

The global Truck-as-a-Service (TaaS) market is projected to grow more than fivefold over the next decade, rising from approximately $29.5 billion in 2025 to $161.76 billion by 2034, according to a report from Towards Automotive.

TaaS refers to a logistics model where businesses rent or lease trucks as needed, rather than investing in their own commercial vehicle fleets. The model has gained momentum in recent years, particularly among companies seeking cost-effective and flexible alternatives to ownership.

Key Trends Driving Market Growth

The rising demand for efficient transportation, coupled with the growth of e-commerce and just-in-time delivery, is fueling adoption of TaaS across various industries. Rather than committing capital to truck ownership and maintenance, businesses are opting for access-based services that allow greater agility and scalability.

By Region:

- North America currently leads the global TaaS market, supported by strong logistics infrastructure, growth in online retail, and a shift toward cost-effective, outsourced transportation models.

- Europe is expected to see significant growth through 2034, driven by rising logistics outsourcing, the push for cleaner transportation methods and tighter emission regulations from regional governments.

By Truck Type:

- Light-duty trucks account for the largest market share, fueled by demand in last-mile delivery, small business logistics and urban freight operations.

By Service Type:

- Renting and leasing dominate the service category, as companies prioritize flexibility and cost savings over capital-intensive purchases.

Cost Efficiency and Operational Flexibility

TaaS offers several advantages for companies looking to scale transportation operations without owning and maintaining their own fleets. It can help reduce capital expenditure, lower operating costs and streamline logistics by outsourcing key components of transportation management.

This shift aligns with broader trends in logistics and supply chain operations, where digital platforms and flexible service models are being used to adapt to market fluctuations, regulatory pressures and rising fuel and labor costs.

As logistics become more complex and customer expectations for fast, reliable delivery continue to grow, models like TaaS may become an increasingly standard part of the transportation landscape.