Construction industry leaders are reporting stable activity in November. Slow deliveries and pricing remain a challenge, while labor has improved. For the second month, concrete remains in short supply.

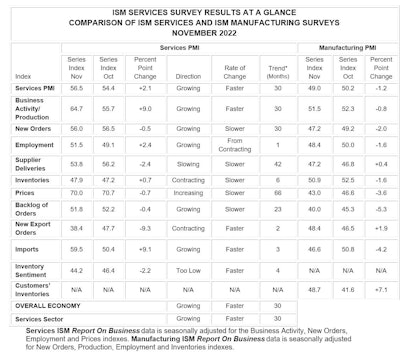

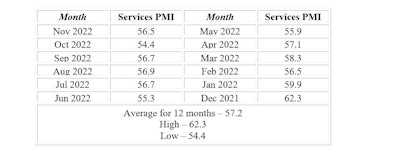

The Institute for Supply Management (ISM) issued its Services ISM Report on Business for November, which registered at 56.5%, showing growth for the 30th month in a row. The reading was higher than October’s. The ISM Services PMI index is a set of economic indicators based off surveys of private-sector companies in the services sector, which includes construction. Construction was the fourth fastest growing sector in the services industry report.

“In November, the Services PMI registered 56.5%, 2.1 percentage points higher than October’s reading of 54.4%,” said Anthony Nieves, chair of the Institute for Supply Management (ISM) Services Business Survey Committee. “The Business Activity Index registered 64.7%, a substantial increase of 9 percentage points compared to the reading of 55.7% in October.”

According to one executive in the construction industry, economic activity in November was, “Generally unchanged month over month. New business requests are solid, with costs rising steadily for materials, meals and lodging,” the respondent said.

Construction had the eighth highest growth of the sectors. The following sectors experienced the most growth in November, listed in order: real estate, rental and leasing, mining, agriculture, forestry, fishing and hunting, other services, construction, health care and social assistance, public administration, retail trade, professional, scientific and technical services, accommodation and food services, utilities, transportation and warehousing and educational services.

According to one mining executive, “The demand for energy services remains very strong for the foreseeable future.”

Meanwhile, a utilities executive pointed out that supply chain issues remain a challenge, “Local, regional and national supply constraints continue to create supply chain complexities and challenges.” [Utilities]

A leader from the wholesale trade sector reported, “Business volume appears to be leveling out based on a month-over-month comparison, although we are up significantly when compared to the same month last year.”

“According to the Services PMI, 13 industries reported growth. The composite index indicated growth for the 30th consecutive month after a two-month contraction in April and May 2020. Growth continues at a faster rate for the services sector, which has expanded for all but two of the last 154 months. The sector had an uptick in growth after pulling back in the previous two months. The rate of growth increased in November due to increases in business activity and employment.”

The 13 services industries reporting growth in November, listed in order: real estate, rental and leasing, mining, agriculture, forestry, fishing and hunting, other services, construction, health care and social assistance, public administration, retail trade, professional, scientific and technical services, accommodation and food services, utilities, transportation and warehousing, and educational services. The three industries reporting a decrease in the month of November are: management of companies and support services, wholesale trade, and information.

Nieves continues, “Supplier deliveries continued to slow, albeit at a slower rate in November. Based on comments from Business Survey Committee respondents, increased capacity and shorter lead times have resulted in a continued improvement in supply chain and logistics performance. A new fiscal period and the holiday season have contributed to stronger business activity and increased employment.”

ISM

ISM

Slow Deliveries Impact Construction

Nieves said the Supplier Deliveries Index registered 53.8%, 2.4 percentage points lower than the 56.2% reported in October. Supplier Deliveries is the only ISM Report On Business index that is inversed, a reading of above 50% indicates slower deliveries, which is typical as the economy improves and customer demand increases.

“Services businesses still continue to struggle to replenish their stocks, as the Inventories Index contracted for the sixth consecutive month, the reading of 47.9% is up 0.7 percentage point from October’s figure of 47.2%,” he said. “The Inventory Sentiment Index (44.2%, down 2.2 percentage points from October’s reading of 46.4%) contracted for the fourth month in a row.”

The Supplier Deliveries Index registered 53.8%, down 2.4 percentage points from the 56.2% recorded in October. A reading above 50% indicates slower deliveries, while a reading below 50% indicates faster deliveries. Comments from respondents include: “Supply chain issues easing” and “Reduced production times and transit times.”

Construction was the fifth most-impacted sector by slower deliveries. The nine industries reporting slower deliveries in November, listed in order: real estate, rental and leasing, mining, health care and social assistance, construction, finance and insurance, educational services, other services, transportation and warehousing, and utilities.

The Inventories Index contracted in November for the sixth consecutive month after four straight months of growth preceded by an eight-month period of contraction. The reading of 47.9% was a 0.7-percentage point increase from the 47.2% reported in October. Of the total respondents in November, 34% indicated they do not have inventories or do not measure them.

Comments from respondents included: “Trying to unload back stock purchased during supplier shortage period” and “Supply chain is improving, production and services are up.” Also, “No need to stock up more than needed, as inventory is being used faster than expected.”

Construction, however, experienced an overall decrease in inventories. The nine industries reporting an increase in inventories in November, listed in order: arts, entertainment and recreation, public administration, agriculture, forestry, fishing and hunting, utilities, information, wholesale trade, educational services, health care and social assistance, and professional, scientific and technical services. The six industries reporting a decrease in inventories in November, listed in order: accommodation and food services, real estate, rental and leasing, management of companies and support services, mining, retail trade, and construction.

Commodities Pricing

There have been several pricing shifts for commodities.

Construction is one of many commodities that increased in price in November. Those that increased in price include (the number of consecutive months the commodity is listed is indicated after each item): batteries, construction services, diesel fuel (2), electrical components (22), fuel* (2), gasoline* (2), janitorial maintenance supplies, labor (24), full-time labor, technology and web related labor, needles and syringes, pallets and services.

Gas and fuel fluctuated up and down in price. Those that are down in price include: fuel* (4), gasoline* (4), and steel products.

Commodities in short supply include: chemicals, concrete (2), electronic components, janitorial supplies, labor, plastic products, semiconductors (2), transformers (3), and vehicles (5).

ISM

ISM

Construction Remains Busy

ISM’s Business Activity Index registered 64.7% in November, a notable increase of 9 percentage points from the reading of 55.7% in October, indicating growth for the 30th consecutive month. Comments from respondents include: “Gaining more business” and “Demand for our services is increasing.”

Construction was the seventh busiest sector for November. The 13 industries reporting an increase in business activity for the month of November, listed in order: real estate, rental and leasing, accommodation and food services, mining, other services, public administration, construction, agriculture, forestry, fishing and hunting, health care and social assistance, information, professional, scientific and technical services, retail trade, transportation and warehousing, and wholesale trade.

Prices Still High

The Prices Index was down 0.7 percentage point in November, to 70%, Nieves reported. For construction, prices were relatively unchanged.

Prices paid by services organizations for materials and services increased in November for the 66th consecutive month, with the index registering 70%, 0.7 percentage point lower than the 70.7% recorded in October. The Prices Index continues to indicate movement toward equilibrium, with a fifth consecutive reading near or below 70%, following nine straight months of readings above 80%.

Sixteen services industries reported an increase in prices paid during the month of November, in the following order: accommodation and food services, real estate, rental and leasing, health care and social assistance, management of companies and support services, public administration, educational services, utilities, information, agriculture, forestry, fishing and hunting, other services, professional, scientific and technical services, arts, entertainment and recreation, mining, retail trade, transportation and warehousing, and finance and insurance. The two industries reporting prices unchanged in the month of November were: wholesale trade, and construction. No industry reported a decrease in prices for November.

Labor Improved Overall

Employment activity in the services sector grew in November after contracting in October. Construction showed improvement in labor levels. ISM’s Employment Index registered 51.5%, up 2.4 percentage points from the October reading of 49.1%. Comments from respondents include: “Slow improvement in staffing levels” and “Recruitment fairs have helped enable open positions to be filled.”

The nine industries reporting an increase in employment in November, listed in order: mining, retail trade, agriculture, forestry, fishing and hunting, arts, entertainment and recreation, construction, public administration, health care and social assistance, professional, scientific and technical services, and utilities. The six industries reporting a decrease in employment in November, listed in order: management of companies and support services, transportation and warehousing, accommodation and food services, information, educational services, and finance and insurance.

New Orders Up

ISM’s New Orders Index registered 56%, down 0.5 percentage point from the October reading of 56.5%. New orders grew for the 30th consecutive month after two months of contraction and a preceding period of 128 months of expansion. Comments from respondents include: “New customers added as our business continues to grow” and “Starting new fiscal year, ramping up projects.”

Twelve industries reported growth of new orders in November, in the following order: real estate, rental and leasing, other services, retail trade, accommodation and food services, agriculture, forestry, fishing and hunting, mining, public administration, transportation and warehousing, health care and social assistance, construction, professional, scientific and technical services, and utilities. The four industries reporting a decrease in new orders in November are: management of companies and support services, wholesale trade, information, and educational services.

Backlog of Orders

The ISM Services Backlog of Orders Index grew in November for the 23rd consecutive month. The index registered 51.8%, 0.4 percentage point lower than the October reading of 52.2%. Of the total respondents in November, 32% indicated they do not measure backlog of orders. Respondent comments include: “Supply chain transportation improvements” and “Slightly more capacity in the supply chain.”

The eight industries reporting an increase in order backlogs in November, listed in order: accommodation and food services, real estate, rental and leasing, information, other services, educational services, health care and social assistance, construction and professional, scientific and technical services. The five industries reporting a decrease in order backlogs in november are: management of companies and support services, finance and insurance, public administration, wholesale trade, and utilities.