Researchers at Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP) issued its latest Logistics Managers' Index, which details inventory levels and costs, warehousing capacity, utilization, and prices, and transportation capacity, utilization, and prices.

The LMI reads in at 58.3 in March, up (+1.8) from February’s reading of 56.5. This is the seventh time in the last eight months that the LMI has shown expansion.

This growth is driven by the buildup of inventories, the subsequent tightening of warehousing, and the ongoing slow yet steady recovery in transportation.

Council of Supply Chain Management Professionals (CSCMP)

Council of Supply Chain Management Professionals (CSCMP)

Key takeaways:

- The overall index is now at the low end of healthy levels of growth, closing in on the all-time average of 62.2 and pointing toward steady economic growth in the near term. The broader optimism of respondents is reflected in the University of Michigan’s Index of Consumer Sentiment, which is up (+3.3%) to 79.4 in March and is 28.1% higher than a year ago.

- Consumers are confident about both the current state of the economy and that inflation will continue to slow down.

- Underlying this is continued job growth and slowing inflation. The United States added 275,000 jobs in February on the back of 229,000 jobs added in January. On the flip side, with more people entering the labor force, the unemployment rate is up to 3.9%, which is higher but still historically low as the United States has now seen unemployment under 4% for 25 consecutive months.

- Inventory levels were up (+5.3) to 63.8 in March, their highest level since October 2022 when firms were desperate to slash inventories. Since this time, inventory levels have largely registered in the 50s and 40s, including contracting in seven of eight months from May to December of 2023. They have been increasing steadily since then and moving back into the mid-60s in March suggests that many firms are now back to business as normal. This normalcy has returned in part due to continued consumer activity.

- Consumer spending was up 0.6% in February. This increase in volumes has naturally come with an increase in costs as well. Inventory costs are up (+3.9) to 66.8. Unlike what was experienced in 2023, many of these costs are being generated upstream. Upstream firms reported robust growth in inventory levels (64.8) whereas their downstream counterparts reported mild contraction (46.7), likely reflecting the unexpected consistency in consumer spending that was mentioned above. Due to this, upstream (70.2) inventory costs are also higher than what is being reported downstream (63.3).

- There was less movement among the transportation metrics in March. Available transportation capacity dipped slightly (-1.3) to 59.6. Transportation capacity moved even less (+0.5), increasing to 57, although metrics show a significant difference between upstream (53.6) and downstream (64.5) firms. In general, there is mixed news on the transportation front, with some firms feeling more confident than others.

- Transportation prices are growing, but at 53, it is a lower rate (-4.6) than February. Even with this slow down, transportation prices have now increased for three consecutive months following what had been 18 straight months of decline. Diesel fuel was up 0.006 dollars per gallon in the last week of March, but still down 9.4 cents from a year ago, providing some relief to carriers. Regular U.S. drivers are seeing no such relief, as prices are up 10.2 cents per gallon from a year ago.

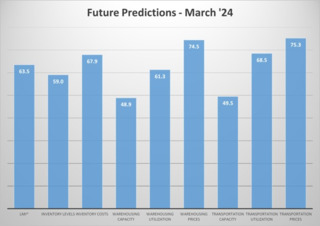

- Respondents continue to be largely optimistic about the future of the logistics industry, predicting an overall growth rate of 63.5, which is up (+1.7) from February’s future prediction of 61.8, and fairly consistent with January’s future prediction of 62.8. The three future predictions through Q1 2024 have all triangulated around the all-time average of 62.2 for the overall index, which suggests that the logistics industry will grow at a healthy, sustainable pace throughout the rest of the year. This moderated growth is at least partially due to a prediction that capacity will finally be right-sized, with mild contraction – bordering on no movement – predicted for warehousing capacity (48.9) and transportation capacity (49.5). The tightness in capacity is predicted to lead to corresponding increases for both warehousing (74.5) and transportation (75.3) prices. This type of price growth may be possible if inventory levels also follow respondent predictions at 59.