Did you know that American roads are about on par with those of Malaysia? That's according to the World Economic Forum's ranking of national infrastructure systems, which shows the U.S. has fallen sharply in the last few years. In the forum's 2007-2008 report, American infrastructure was ranked 6th best in the world. The 2011-2012 report due in September will show America at No. 16, with South Korea overtaking the U.S. during the last year, according to the ranking obtained by Reuters.

The U.S. spends only 1.7% of its gross domestic product (GDP) on transportation infrastructure while Canada spends 4% and China spends 9%. Even as the global recession has forced cutbacks in government spending, other countries continue to invest significantly more than the U.S. to expand and update their transportation networks. This of course has an impact on the competitiveness of America with the rest of the world.

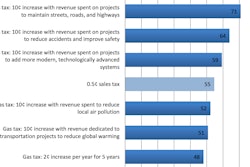

There's much debate about the expiration of the gas tax at the end of September. In addition to the 18.4-cent tax on gasoline, there's a 24.4 cent levy on diesel fuel and several other revenue provisions, such as a tax on heavy truck tires, which are all vital to supplying the Highway Trust Fund. The money is then divvied up for highway and transportation projects across the country.

In past years, the gas tax has been reauthorized repeatedly without much controversy. But earlier this month, a leading anti-tax conservative, Grover Norquist, hinted that he would like to use the Sept. 30 expiration as a way to spur debate over the federal gas tax.

Let's take a closer look at what Americans pay at the pump compared to other countries. Americans tend to misunderstand the current tax rates and the actual costs of the gas we use, says a report by Building America's Future (BAF), titled "Falling Apart & Falling Behind." According to a poll conducted by BAF, most Americans mistakenly believe that the gas tax goes up every year. In fact, the U.S. federal gas tax has remained unchanged for nearly 20 years – and it’s a fraction of the gas taxes collected in other countries.

Even accounting for state taxes, Americans pay an average of 39 cents a gallon in gas taxes, far less than in other leading economies. The retail price for unleaded premium gasoline ins two to three times higher in Europe, Australia, Japan and Korea than in the U.S., and gas taxes in some countries are nearly 10 times as high as the average American gas tax.

According to the BAF report, other countries have imposed higher taxes on oil both to cover the costs of the highway wear and tear imposed by vehicles as well as to cover some of the environmental costs. In the U.S., gas taxes cover only half the costs of maintaining and operating our roads, while gas tax receipts in industrialized European nations more than cover the costs of their highways.

America used to be proud of its highways – and it seemed we liked to be the best in the world. Now our infrastructure is crumbling and some are talking about getting rid of one of the mechanisms that helps fund the maintenance of our highway system. Not only do I think we need to keep the gas tax, I think we need to raise it. America is a great country; let's keep it that way by putting our money where our mouth is.

Related articles

Why the Gas Tax Is Essential (newser.com)

Gas Tax Hostage Situation Would Create a Windfall for Oil Companies (news.firedoglake.com)

Editorial: The Clear Case for the Gas Tax (nytimes.com)

Ending the Gas Tax Would Be a Disaster (ecocentric.blogs.time.com)

Is Renewing Federal Gas Tax the Next Big Fight on the Hill? (turnergpa.wordpress.com)

A Few Facts about the Gas Tax

Aug 25, 2011

Latest in Business

EarthCam Launches Command Watch24 for Enhanced Jobsite Security

December 7, 2025

ABC Elects Thomas “Murph” Murphy as 2026 National Chair

December 6, 2025

Astec Enters Agreement To Acquire CWMF

December 5, 2025