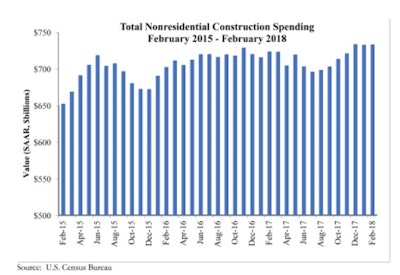

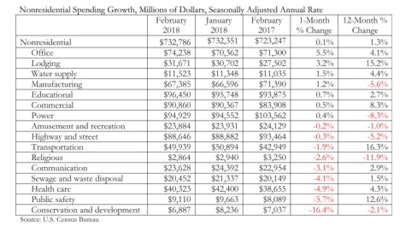

Nonresidential construction spending inched 0.1% higher in February, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data. Nonresidential spending, which totaled $732.8 billion on a seasonally adjusted, annualized basis, has expanded 1.3% since February 2017.

Private sector nonresidential construction spending increased 1.5% on a monthly basis and 1.1% on a yearly basis, while public sector nonresidential spending fell 2.2% for month. Public-dominated segments like conservation and development (-16.4%) and public safety (-5.7%) experienced especially steep declines in February.

“Construction spending growth tends to reflect the degree to which new project starts exceed project conclusions,” said ABC’s Chief Economist Anirban Basu. “In a healthy economy, the expectation is that there will be considerable numbers of project starts and that, as a result, construction spending growth will be vigorous. The economy is certainly healthy judging from a wave of leading indicators, including measures of confidence, employment, new orders and gross domestic product.

“Concerns regarding rising materials prices are also becoming more intense, particularly in light of the recent enactment of tariffs on steel and aluminum and growing fears of a trade war and materials shortages. Softwood lumber prices, which have been impacted by an ongoing trade dispute with Canada, were up nearly 16% over a recent 12-month period. On top of all of this is sporadic growth in public construction spending as government monies continue to be siphoned away to finance underfunded pensions, Medicaid and other public priorities.

“The expectation remains that 2018 will be a solid year for construction spending growth. However, there are a growing number of headwinds, even in the context of a reasonably strong domestic economy,” said Basu. “Elected officials could help support construction spending momentum by reducing the level of uncertainty now emerging from the policymaking environment. Obviously, passage and implementation of the long-awaited federal infrastructure package also would help.”