The outlook for the North American building materials industry has been changed to positive from stable, Moody's Investors Services says in a new report. Higher volumes and prices, increased government spending and positive economic indicators should see operating income grow by more than 7 percent in the next 12 to 18 months.

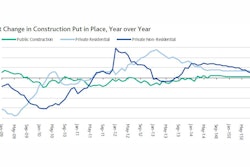

"All three of the building material industry's end markets are showing signs of strength," says Vice President -- Senior Credit Officer, Karen Nickerson in "End Markets Pave Recovery Road as Private, Public Spending Converge for Positive Outlook." "While private residential construction has been the main driver of growth over the past year, positive trends are developing in private nonresidential construction and public construction is stabilizing."

Building materials companies have high fixed costs, and are positioned to benefit from the leverage that comes with increasing volumes, Nickerson says. In the wake of the recession, volumes finally stopped declining in 2012 and grew at low-single-digit rates last year; and on the back of the broader economic recovery, the reversal is now gaining momentum.

Companies including Martin Marietta Materials, Vulcan Materials, U.S. Concrete and Summit Materials reported increased volumes and higher pricing for building materials in the first half of 2014. They should see higher operating income and margins, as well as improved profitability and credit metrics, as a result. Meanwhile, cost inflation is expected to remain manageable.

Spending on private residential construction for Moody's-rated building material companies was up 8 percent over the previous year as of July 31. Housing starts were also up 21.7 percent. Spending on private nonresidential construction was up 14.1 percent over the same period. The private residential sector should remain healthy, Moody's says, and private nonresidential should continue to improve.

In public construction, a $10.8 billion cash infusion has topped up the coffers of the federal Highway Trust Fund through May next year, providing stability and ensuring that transportation grant dollars continue to flow through the busy summer building season. Public construction is also drawing strength from state initiatives that fund their infrastructure needs without federal dollars.