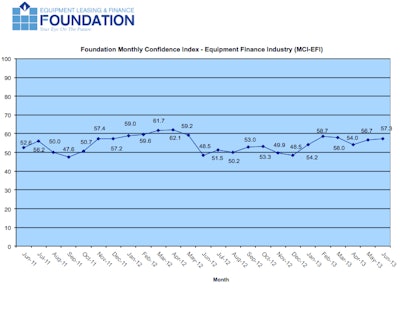

The Equipment Leasing & Finance Foundation (the Foundation) released the June 2013 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. Designed to collect leadership data, the index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $725 billion equipment finance sector. Overall, confidence in the equipment finance market is 57.3, an increase from the May index of 56.7, reflecting industry participants’ increasing optimism despite continued moderate growth of business investment in equipment.

“Demand for equipment leases has increased significantly over the last 60 days," said MCI survey respondent Thomas Jaschik, President, BB&T Equipment Finance. "Whether this is a seasonal factor or an indicator of an improving economy is subject to debate. If demand continues throughout the summer than perhaps we can give the nod to an improving economy.”

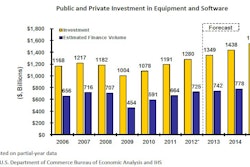

Equipment Leasing & Finance Foundation Forecasts for 2013

June 2013 survey results:

When asked to assess their business conditions over the next four months:

- 19.4% of executives responding said they believe business conditions will improve, up from 9.7% in May

- 71% believe business conditions will remain the same, down from 87.1% in May

- 9.7% believe business conditions will worsen, up from 3.2% the previous month

- 19.4% believe demand for leases and loans to fund capital expenditures (capex) will increase, up from 12.9% in May

- 71% believe demand will “remain the same”, down from 80.6% the previous month

- 9.7% believe demand will decline, up from 6.5% in May

- 19.4% expect more access to capital to fund equipment acquisitions, down from 25.8% in May

- 80.6% expect the “same” access to capital to fund business, an increase from 74.2% the previous month

- No one expects “less” access to capital, unchanged from May

- 29% expect to hire more employees, an increase from 19.4% in May

- 67.7% expect no change in headcount, down from 71% last month

- 3.2% expect fewer employees, down from 9.7% who expected fewer employees in May

When evaluating the current U.S. economy:

- 90.3% evaluates the current U.S. economy as “fair,” unchanged from last month

- 9.7% rate it as “poor,” also unchanged from May

When asked to assess conditions over the next six months:

- 22.6% believe that U.S. economic conditions will get “better”, a decrease from 32.3% in May

- 71% believe the U.S. economy will “stay the same”, an increase from 64.5% in May

- 6.5% believe economic conditions in the U.S. will worsen, an increase from 3.2% who believed so last month

- 25.8% believe their company will increase spending on business development activities, unchanged from May

- 74.2% believe there will be “no change” in business development spending, unchanged from May

- No one believes there will be a decrease in spending, unchanged from May