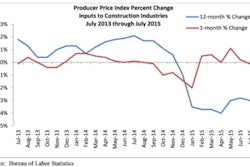

Prices for inputs to construction industries declined 0.1% in July after increasing 0.2% in June, according to the Aug. 14 Bureau of Labor Statistics producer price index. Year-over-year prices were down 3% in July and have been down on an annual basis for each of the past eight months. Prices of inputs to nonresidential construction industries declined 0.3% on a monthly basis and are down 3.9% on a yearly basis.

Prices for inputs to the construction industry fell 0.9% in August after shedding 0.1% in July. Inputs to nonresidential construction behaved similarly, losing 0.8% for the month and 4.7% for the year.

On a year-over-year basis, prices were down 3.9% for the month and have fallen by at least 2.8% in each month this year. Prices have now fallen on a yearly basis in nine consecutive months, the longest such streak since March to November of 2009.

"Commodity markets were particularly frenzied in August due to a series of events in China, Brazil, Iran and other parts of the world," said Associated Builders and Contractors Chief Economist Anirban Basu. "The result is that input prices continue to slide lower, defying predictions from earlier this year suggesting that commodity prices would stabilize and at some point head higher. Global demand remains low and there is a chance that prices could fall even lower during the months ahead.

"This is good news for most contractors, with the obvious exception being those in commodity-rich communities," said Basu. "Already, North Dakota, Oklahoma, New Mexico and Alaska are deemed to be at risk of recession, and the ongoing slide in commodity prices will only serve to further weaken those economies and suppress overall construction activity."

Only three key input prices rose in August:

- Prepared asphalt, tar roofing and siding expanded 2.2% for the month and 2.4% for the year.

- Natural gas prices expanded 2.2% on a monthly basis but are down 29.2% for the year.

- Plumbing fixtures and fittings expanded 0.2% from July and are up 1.2% from August 2014.

The key input prices that fell or remained flat include:

- Crude energy materials prices fell 9.5% in August and are down 40.5% from the same time last year.

- Fabricated structural metal product prices remained unchanged for the month and are down 0.4% on the year.

- Iron and steel prices fell 2.9% for the month and 17.6% for the year.

- Prices for steel mill products fell 0.7% from last month and 14.1% from last year.

- Nonferrous wire and cable prices are down 1.1% in August and 6.9% from the same time last year.

- Softwood lumber prices fell 3.2% on a monthly basis and 7.5% on a yearly basis.

- Prices for concrete products inched 0.2% lower in August but are up 2.6% from the same time last year.

- Crude petroleum prices plummeted 20% in August and are down 57.3% from the same time last year.

View the July 2015 PPI report.