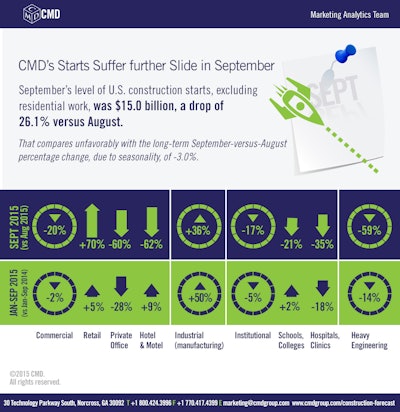

September’s level of U.S. construction starts, excluding residential work, was $15 billion, a drop of 26.1% versus August, according to CMD. That compares unfavorably with the long-term September-versus-August percentage change, due to seasonality, of -3%.

The last time monthly starts were as weak was in February 2012 ($13.9 billion). But at that time, winter weather, with its customary inhibiting effects, was partly the cause. There hasn’t been a worse September figure in the past decade.

The sharp drop in total starts has been mainly due to a dramatic contraction in one major sub-category, heavy engineering. Road/highway work, in particular, has gone into hibernation.

That’s not the end of the disappointing news. Comparing the standalone month of September this year with the same month of last year yields a decline of 41.8%.

Year-to-date starts in 2015, though, are still holding up. When compared with the same January-to-September period of last year they are down only 5.8%.

The starts figures throughout this report are not seasonally adjusted (NSA). Nor are they altered for inflation. They are expressed in what are termed ‘current’ as opposed to ‘constant’ dollars.

Nonresidential building plus engineering/civil work accounts for a considerably larger share of total construction than residential activity. The former’s combined proportion of total put-in-place construction in the Census Bureau’s September report was 64%; the latter’s was 36%.

In its latest Employment Situation report, the Bureau of Labor Statistics (BLS) sets out a total construction employment increase of 8,000 jobs in September. The year-to-date gain has been 121,000, or 13,400 per month. Total non-farm employment in September was 2% year over year. Construction’s change was stronger at 3.3%. Nevertheless, there has been a gradual slowing in the sub-sector’s year-over-year improvement, which was at its best in December 2014, 5.7%.

The unemployment rate in construction in September tightened to 5.5% from 6.1% in August. A year ago, it had been 7%; two years ago, 8.5%.

Total jobs in architectural and engineering services in September were flat (0.0%) after August’s 0.3% decline. The latest month’s year-over-year change was 2.6%, continuing to step down from March’s 3.9% peak.

Among the three major subcategories of nonresidential construction starts, heavy engineering work recorded, by far, the biggest drop in September, -58.9% month over month. (Road/highway work was -89.3%). Institutional (-16.8%) and commercial (-20.1%) starts were also down, but to considerably lesser degrees.

The dollar volume of industrial starts (36.4% month to month in September) is usually much lower than for the other three categories and its percentage change can be inordinately influenced by go-aheads for one or two mega projects.

Comparing the individual month of September this year with the same month of last year, engineering starts (-83.1%) all but disappeared. The institutional category wasn’t down by much (-12.3%), while commercial (-24.8%) dropped by about one-quarter. Industrial was up 410%.

In year-to-date starts, nonresidential building work has held steady (-1%), with declines in commercial (-2.4%) and institutional (-5.2%) offset by an increase in industrial (+49.9%)

By a sizable measure, road/highway is the largest sub-component of heavy engineering. On a year-to-date basis, its dollar volume is -14.6%. But that masks the alarming fact that over the last two months, road/highway starts first dropped by more than half, then almost dried up. Uncertainty about the availability of funds from Washington to help finance such projects has opened up formidable fissures along the approvals path.

Water/sewage work, the second biggest category within engineering, was also in distress in September: -82.5% month over month (m/m); -88.4% year over year (y/y – i.e., September 2015 vs September 2014); and -12.1% year to date (ytd – i.e., compared with the same January-to-September period of last year).

The school/college subcategory, which is dominant within institutional construction, was: -21.3% m/m in September; and -5% y/y; but +1.6% ytd.

Hospital/clinic starts were a drag as well: -35.4% m/m; -53.2% y/y; and -17.8% ytd. The nursing/assisted living (+30.9% m/m; +22.7% y/y; and +19.1% ytd) and police/courthouse/prison (+26.6% m/m; +51.8% y/y; and +67.6% ytd) categories, however, were entirely in the ascendant.

Within commercial, private office (-59.7% m/m; -69% y/y; and -27.6% ytd) and government office (-30.8% m/m; -37.6% y/y; and -13.9% ytd) are languishing.

Warehouse (-27.4% m/m; and -41.8% y/y; but +20.4% ytd) and hotel/motel (-62.2% m/m; and -32.7% y/y; but +9.1% ytd) are telling mixed stories.

Retail (+69.6% m/m; +40.9% y/y; and +4.9% ytd), on the other hand, is uniformly on the upside.

In addition to the declining slopes for several heavy engineering sub-components, private office buildings seem stuck in a downward trajectory.

September’s Employment Situation report from the BLS shows total private-sector average hourly earnings staying the same as in July, at +2.2% year over year. Average weekly earnings pulled back from +2.5% to +2.2%. In construction, average hourly earnings slowed from +2.7% to +1.9%, while average weekly earnings retreated from +2.2% to a barely discernible +0.6%.