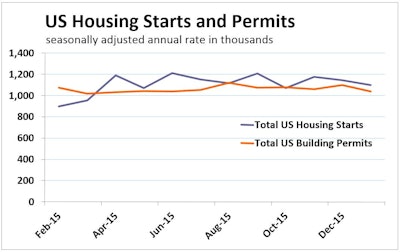

Total U.S. housing starts fell 3.8% in January to a 1.099 million-unit pace -- its weakest rate in three months -- despite economists’ expectations for a modest gain. December starts were downwardly revised to a 2.8% decrease.

Both single- and multifamily housing starts fell in January, decreasing 3.9% and 3.7%, respectively.

Consensus estimates had called for some slight improvement in both December and January due to milder-than-usual weather. While January temperatures were colder than in December, they remained warmer than average with the worst of the cold and snow not arriving until near the end of the month.

Both single- and multifamily production dropped in January. Single-family housing starts fell 3.9% to a seasonally adjusted annual rate of 731,000 units while multifamily starts declined 3.7% to 368,000 units.

Combined single- and multifamily starts fell in all four regions in January:

- West: -0.4%

- South: -2.9%

- Northeast: -3.7%

- Midwest: -12.8%

Wells Fargo Economics’ analysis of the Commerce Department’s January housing numbers reassured market watchers, “January is typically the least important month of the year for homebuilding, which means that seasonal adjustment distortions can be rather significant.”

“January’s production numbers are in line with our recent HMI reading and show that builders are being cautious as they face some market uncertainties and supply-side constraints,” said Ed Brady, chairman of the National Association of Home Builders and a builder/developer from Bloomington, IL.

Wells Fargo responded to the January softness in residential permit issues – which slipped 0.2%, dragged down by a 1.6% drop in single-family permits – with cautious optimism.

“With the level of single-family permits running below starts, we could see further weakness in coming months. We have seen some improvement in development activity, particularly in the South and West, which should lead to rising permits and starts this spring.”

Permits for multifamily homes rose 2.1% following their 15% percent plunge in December.

Regionally, permits changed:

- Midwest: +26.5%

- West: +25.4%

- South: +0.3%

- Northeast: -55.4%

“Despite the modest dip in starts this month, we expect to see ongoing, gradual growth in housing production in 2016,” said NAHB Chief Economist David Crowe. “An improving economy, solid job creation and pent-up demand for housing should keep the market moving forward.”

Wells Fargo agrees with Crowe. “We continue to believe that the housing market will be one of the bright spots for the domestic economy in 2016. We are looking for overall starts to total 1.2 million units in 2016 and 1.25 million units in 2017.”