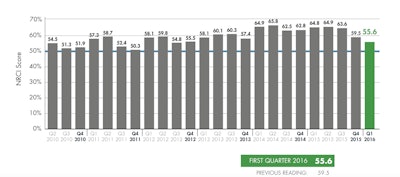

The FMI Nonresidential Construction Index (NRCI) for the first quarter 2016 dropped 3.9 points to 55.6. That is the third consecutive quarter that the NRCI has dropped since reaching 64.9 in the second quarter of 2015. An index number of 55.6 by itself is an indication of growth, albeit slower growth. The last time the NRCI was in that range was the fourth quarter of 2012, and the index began to climb in the ensuing quarters.

What we are concerned about is not the single-quarter results but the recent trend. Nonetheless, it is worth noting that 55.6 is the median score for the NRCI since its inception in the fourth quarter of 2007 and slightly above the historical average. On the other hand, after being over 60.0 for seven quarters, maybe we have reached the Goldilocks Zone at least for the current quarter.

In the results of our NRCI survey this quarter, we find both hot and cold responses. It is at first a puzzlement to understand why so many NRCI panelists have downgraded their views of the economy and nonresidential construction markets when most who wrote comments also said they are busier than ever and hiring plans are nearly the same or higher than last year.

The immediate problem is that construction companies cannot find the people they need to hire in order to increase productivity, work off backlogs and develop good people to run the company as current management starts to retire. Then there is the uncertainty hanging over the economy that causes concerns that the markets are likely to cool too fast.

Right now, many in the industry seem to agree with what one panelist wrote in our responses to the question about challenges for 2016: “Opportunity will be ample, industry capacity to push it through the pipe as quickly as needed will be the challenge.” What we learn from this, the 34th round of the NRCI, is that contractors need skilled employees to keep up with the work they have in their backlogs, execute plans for future growth and develop good people to run the company as current management starts to retire.

NRCI First Quarter 2016 Highlights

- NRCI panelists’ outlook for the overall economy continued to slip in the first quarter, moving from 58.3 to 56.5. This is a drop of over 20 points from Q2 2015.

- The component for the economy where panelists do business dropped 7.5 points from 64.8 to 57.3 in the first quarter.

- Panelists’ construction business is still strong at 64.1, but that represents a drop of 5.8 points since the fourth quarter 2015.

- At 60.6, the nonresidential construction markets where panelists do business are still in solid growth mode; however, this component signals expected slower growth, dropping 4.7 points since last quarter.

- The median backlog for all responses fell from a high of 12 months to 11 months, still higher than the historical average for the NRCI survey.

- While still considered high, the cost of materials component improved 7.5 points to 38.1. Little changed since last quarter, the cost of labor continues to rise. Note that the NRCI composite score is affected negatively when cost of major inputs of materials and labor increase.

- While productivity gained slightly in the first quarter, it is still the most difficult area to make significant improvements in the construction industry.