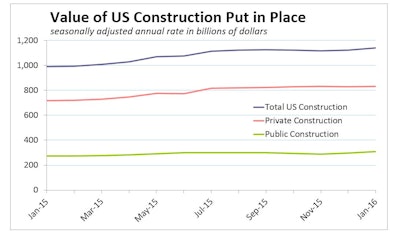

The total nominal value of U.S. construction spending put in place rose 1.5% in January to a seasonally adjusted annual rate of $1,140.8 billion from an upwardly revised estimate of $1,123.5 billion in December. Construction spending is now up more than 10% relative to a year earlier. Public spending jumped 4.5% during the month, according to estimates by the U.S. Census Bureau of the Department of Commerce, while private spending grew a modest 0.5%, restrained by mostly flat residential outlays.

Spending on single-family residential units (-0.2%, but 6.6% above January 2015) and home improvements both declined in January, while multifamily grew 2.6%, posting its third consecutive monthly gain.

“We are not surprised that residential construction spending tumbled during the month as housing starts and new home sales were also weak,” said Anika Kahn, senior economist with Wells Fargo. “We expect residential spending to strengthen in the coming months as we get some payback from the lower- than-expected January reading and warmer weather supports building.”

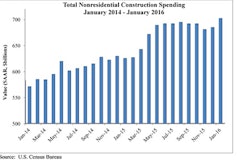

Nonresidential constructions revived

Private nonresidential outlays and public construction spending posted strong gains during the month. Following two consecutive monthly declines, private nonresidential construction spending rose a solid 1.0% in January on the back of strong monthly gains in manufacturing (+4.2%) and power (+2.7%), and is now 11.5% above January 2015. Manufacturing outperformed last year with notable gains in the chemical and transportation sectors; however, the overall pace of growth is starting to slow.

“While January is a difficult month to interpret and one that should not be overly emphasized, the fact of the matter is that the year-over-year performance in spending is consistent with a host of industry indicators,” said Anirban Basu, chief economist with the Associated Builders & Constructors in his analysis of the Census Bureau's January construction-spending numbers. “For many months, the average contractor has been reporting decent backlog. Measures of industry confidence have remained stable even in the face of adverse news coming from various parts of the world.

“While the nonresidential construction spending recovery appears to remain in place, the industry’s overall outlook remains murky,” Basu continued. “The U.S. economic recovery continues to be under-diversified, with consumers continuing to lead the way. If corporate profitability continues to struggle, given falling exports and a general lack of confidence among CEOs, the pace of employment growth will slow over the course of 2016. That will presumably affect consumer spending, which is already being hampered by rising health care costs.”

Weak January outlays in private commercial (-4.8%, down 0.8% compared to January 2015) and communication (-4.3%, but 27.3% above last January) detracted from headline growth. Weakness in private commercial spending was underscored by declines in the automotive, food/beverage, and multi-retail sector, while warehouse construction posted a gain. Construction spending on warehouses was up more than 14% over the past year.

Construction outlook remains bright

The American Institute of Architects’ (AIA) Architecture Billings Index, which typically leads nonresidential construction spending by nine to 12 months, registered an average score of 51.6 in 2015, which is a slightly lower than the 52.2 reading posted in 2014. That said, any Index level above 50 indicates expansion, so the current reading continues to signal growth in nonresidential construction spending in 2016.

Other forward-looking indicators, including the Dodge Momentum Index and nonresidential construction starts, also advanced last year supporting a positive outlook.

According to the AIA Consensus Construction Forecast Panel, outlays in the nonresidential sector are expected to increase about 8% in 2016, and 7% in 2017, which is in line with the Wells Fargo forecast.

“We acknowledge there are downside risks to our forecast given continued uncertainty around global economic growth and financial market volatility,” said Kahn, from Wells Fargo. “That said, builders remain optimistic and strength in U.S. domestic demand suggests continued gains.”