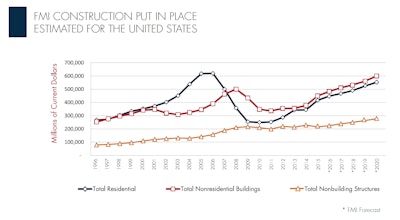

Construction had a busy year in 2015, adding 11% growth to reach nearly $1.1 trillion in construction put in place. In current dollars, that is the highest total since 2008 and the highest growth rate since 2005. Signs that the rate of growth for the industry is slowing have caused us to forecast a slower 6% rate of growth to reach $1.6 trillion in 2016. In nonresidential construction, highway and street construction will be the volume leader, in part thanks to a new highway bill and the fact that this is always a top sector.

Manufacturing

Manufacturing construction took a heavy hit during the Great Recession, but it has more than caught up as of 2015, with a whopping growth of 44% for the year and a more modest 9% growth expected for 2016. In either case, new records are being set for manufacturing construction investment. While, at 76.1 for February 2016, manufacturing capacity utilization is still below the long-term average of 78.5, there are signs that new capacity is being well utilized.

Lodging

Lodging construction continued to rise above even increasingly optimistic forecasts for 2015 to end the year with 31% growth. At this point, FMI again expects the rate of growth to cool, but, at 15% for 2016, it will still be the fastest-growing construction market. With an expected value of $24.3 billion for 2016, this market is well below its high of $35.8 billion in 2008, but we expect these numbers to be more sustainable with a mix of new venues and refurbishing established locations.

Office

After a strong show of growth in 2015 (22%), we expect office construction to cool in 2016 to a still respectable rate of 9% growth. Much of the growth has come from an increase in employment, especially in high-tech job markets. These high growth rates will taper off to more sustainable rates in 2017 and beyond. Continued growth in the technical sector and in larger metropolitan areas like New York City will keep rents and absorption of new space high.

Power

After a strong year in 2014, power construction declined sharply in 2015, losing 14%. FMI expects another 4% drop in 2016, thus giving up the gains realized since 2012. The power industry is in flux due to changing fuel supplies using more natural gas and less coal as well as variable rates of growth in alternative energy sources like solar and wind. Power plants must be updated to keep up with changing requirements as well as to manage distributed generation sources. Despite losing subsidies and the lower cost of oil and gas, wind and solar power generation facilities are growing. The power industry will continue to consolidate as the average consumer reduces power use, but growth will slow in 2016 and 2017.

![[VIDEO] 2016 Construction Spending to Slow After Hot 2015](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2016/04/default.571fd7883fc58.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)