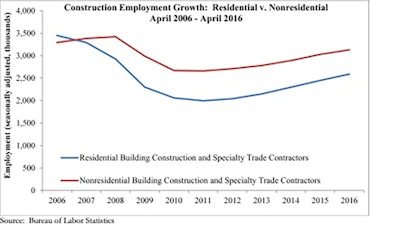

The U.S. construction industry added just 1,000 net new jobs in April according to an Associated Builders and Contractors (ABC) analysis of U.S. Bureau of Labor Statistics (BLS) release. Although industry-wide job growth was marginal, the nonresidential construction sector added 6,600 net new jobs for the month. Revisions to the previous two months of construction data produced a net decrease of 3,000 jobs, with March's construction employment estimate raised by 4,000 jobs but February's downgraded by 7,000 positions.

"There has been a significant volume of data indicating that residential construction has been slowing, including today's report," said ABC chief economist Anirban Basu. "This may be due in part to growing concerns in various parts of the nation that the multifamily rental market is on its way to being overbuilt.

"Since these are April data, one can no longer attribute results to meteorological forces," said Basu. "There is a conventional notion that residential construction leads commercial construction. Nonresidential contractors have benefited from the surge in multifamily residential construction in recent years because developers frequently incorporate retail or other commercial components into their projects. The slowing in residential construction may partially explain the recent softness in nonresidential construction spending. If that softness persists, the pace of nonresidential construction job growth will of course also slow.

"For now, increased spending on hotels, office buildings, data centers and warehouses related to e-commerce is helping support nonresidential job creation," said Basu. "The bigger issue for contractors is not excess labor but difficulty locating appropriately skilled labor. The construction industry's unemployment rate is down to 6%. This represents the largest month-over-month decrease in the unemployment rate since April 2005. Firms are responding by offering more hours to current workers. The average workweek expanded by four-tenths of an hour in April to 39.1 hours per week, and average weekly earnings rose by nearly $14."

According to BLS's estimates, residential specialty trade contractors took the brunt of the hit, losing 10,900 positions for the month. The heavy and civil engineering sector lost 2,200 positions. Despite this, the nation's nonresidential construction sector added 6,600 net new jobs in April.

- Nonresidential building employment expanded by 1,100 jobs in April and is up by 25,500 jobs or 3.5% on a year-over-year basis.

- Residential building construction employment expanded by 7,100 jobs in April and is up by 37,500 jobs or 5.4% on a year-ago basis.

- Nonresidential specialty trade contractors added 5,500 jobs for the month, and employment in that category is up by 76,700 jobs or 3.3% from the same time one year ago.

- Residential specialty trade contractors reduced payrolls by 10,900 in April but have added 103,300 jobs or 5.9% since April 2015.

- The heavy and civil engineering construction segment lost 2,200 jobs in April and is up by 17,900 positions or 1.9% on a year-over-year basis.

![[VIDEO] Caterpillar Plans More US Manufacturing Plant Closures](https://img.forconstructionpros.com/files/base/acbm/fcp/image/2016/05/default.57348f6b1e8d9.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)