A surprisingly weak labor-market report clearly influenced the Federal Reserve’s decision to keep interest rates steady this week. The Fed noted that jobs gains have slowed and business investment has been soft. Housing, however, remains a bright spot as the economy picks up speed entering the second quarter.

At the conclusion of its two-day meeting Wednesday, the Federal Open Market Committee opted to hold rates constant, with no dissenting votes. The monetary policymaking body also reduced its projection of future rate increases. While the Fed is still signaling two increases for 2016, a larger number of officials envision only one rate hike (six officials compared to just one in March). Like many economic indicators associated with this recovery, the normalization of monetary policy is going to take a longer period of time than many had expected.

The primary data affecting the Fed was the labor market report from the Bureau of Labor Statistics (BLS), which revealed the economy gained only 38,000 net jobs in May. And the increases recorded in March and April were revised down by 59,000. While the unemployment rate ticked down to 4.7% for the month, it was the result of the labor force losing 458,000 workers.

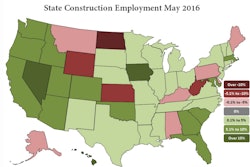

The residential construction sector was no exception to the weakness in hiring. After a strong run that began in the second half of 2015, home builders and remodelers shed a combined 9,600 net positions over the course of April and May. These two monthly declines cut the six-month moving average of residential construction employment gains in half, to an average of about 10,000 a month. Mirroring the overall economy, the unemployment rate for the construction occupation fell to 5.6% on a seasonally adjusted basis in May.

While declines in multifamily permitting activity may be a contributing factor, labor continues to be in high demand as many builders are finding difficulty replacing departing workers, let alone adding to overall employment. This is seen most clearly in the BLS JOLTS data, which revealed a total of 200,000 unfilled positions in the construction sector for April, near the cycle high of 215,000 recorded in March.