Minutes released this week from the mid-June meeting of the Federal Open Market Committee (FOMC), monetary policymaking body of the Federal Reserve, suggest that today’s low interest rates are unlikely to change soon.

“Almost all participants judged that the surprisingly weak May employment report increased their uncertainty about the outlook for the labor market,” the FOMC minutes note. “Even so, many remarked that they were reluctant to change their outlook materially based on one economic data release.”

The meeting minutes suggest the Fed expects monthly gains in payroll employment will resume and “that would be sufficient to promote continued strengthening of the labor market. However, some noted that with labor market conditions at or near… maximum employment, it would be reasonable to anticipate that gains in payroll employment would soon moderate from the pace seen over the past few years.”

The next labor report is due on July 8.

(more on FOMC meeting minutes . . . )

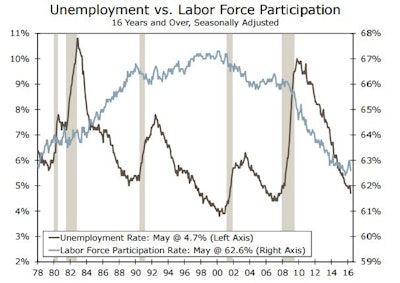

Mixed readings of jobs figures are no surprise, given today’s changing perspective on nature of unemployment.

“While the unemployment rate is now clearly in the neighborhood of full employment, a sub-five percent unemployment rate does not mean the same thing it did a decade ago,” according to the Wells Fargo Economic Group’s analysis of current employment numbers. “Most notably, the labor-force participation rate has fallen precipitously since the last recession and is currently hovering near 40-year lows. A significant part of this drop is due to demographics, primarily aging baby boomers reaching a point where a smaller proportion tend to work or look for work and a larger proportion of younger workers are pursuing higher education opportunities.”

Wells Fargo calls the current U.S. situation “quasi-full employment,” and adds that it is also unique, in a way that can directly affect consumer spending and inflation, because of how workers view their jobs.

“Job insecurity is clearly higher today than it was the last time the unemployment rate fell below 5% back in 2006,” the Wells Fargo analysis points out. “Compared to 2006, fewer workers feel jobs are plentiful today and more workers feel jobs are hard to get. Underemployment also appears to be higher today, with more workers employed as independent contractors or working in the gig economy.”