The outlook for the US building materials industry remains positive, Moody's Investors Service says in a new report. Construction end markets are improving, bolstered by favorable economic indicators and strong underlying demand. As a result, operating income is expected to grow more than 10% over the next 12-18 months.

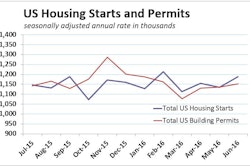

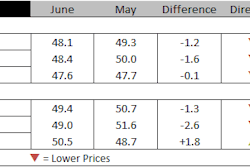

"Demand for building materials remains strong across the US, with shipment volumes and prices rising," said Karen Nickerson, Vice President -- Senior Credit Officer. "Residential construction continues to benefit from employment growth, pent-up demand from low levels of construction activity over the past few years and low mortgage rates, while private non-residential spending will moderate this year after a strong 2015."

Meanwhile, public construction activity is set to gain from recent federal, state and local transportation initiatives, Nickerson says in "Volume, Price Momentum Endure; Private and Public Spending Lift End Markets." In particular, the passing of the federal Fixing America's Surface Transportation Act, or FAST Act, supports increased long-term transportation infrastructure spending by 2017, to the benefit of all Moody's-rated US building materials companies.

Solid and improving end-market fundamentals continue to drive volume and price growth for aggregates, ready-mixed concrete and cement, Moody's new report says. Additionally, the Atlantic coast and southeastern markets, which have lagged other areas in recent years, are beginning to participate more fully in the recovery.

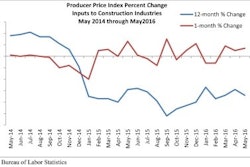

Improved leverage of fixed costs due to increased production, as well as lower diesel costs and favorable pricing, have translated into higher profits and improved overall credit metrics for US building materials companies. Improved profitability and, to a lesser extent, reduced balance sheet debt, have led to positive rating actions across the board for Moody's-rated building materials companies this year, and further improvements are expected.