Robust economic conditions, elevated confidence levels and low interest rates will support further expansion of construction activity particularly in Asia Pacific and North America and underpin the stable outlook for the global construction sector into 2019, says Moody's Investors Service in a report published today.

Click here to access Moody's report: "Construction -- Global: Robust economies, higher confidence and low interest rates keep outlook stable" The report is also available at www.moodys.com. The rating agency's report is an update to the markets and does not constitute a rating action.

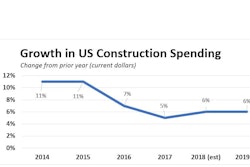

"Continued strong economic growth in a number of major developed and emerging markets coupled with attractive financing conditions on the back of very low interest rates will boost average global construction industry revenues by 5% into 2019, keeping our outlook on the sector stable," says Goetz Grossmann, Assistant Vice President -- Analyst at Moody's.

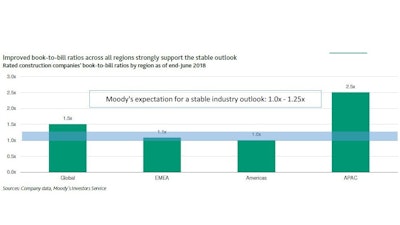

An average book-to-bill ratio for the global construction sector forecast at 1.2x also reflects the current healthy industry conditions and suggests sustained revenue growth during 2019 and beyond.

Asia Pacific and North America will see the fastest surge in revenues (up to 10% and 6%, respectively). China revenues will advance by 8% or more as demand remains strong, mainly in the country's transport infrastructure segment. In the US and Canada, still healthy residential and a pickup in commercial construction activity will drive volumes.

Europe's healthy order books will underpin mid-single-digit revenue growth in the region, bolstered by improved construction industry confidence and budgetary conditions in several countries, which bode well for residential and public infrastructure spending. In the UK, political and economic uncertainty as well as fragile business confidence due to the ongoing Brexit negotiations will stifle construction output.

LatAm's prospects remain gloomy with construction companies likely to struggle on because of weaker-than-expected economic growth in some major countries, stagnant investment levels particularly in Brazil, political uncertainties, shrinking order backlogs and constrained liquidity.

Higher commodity prices might accelerate investment and support construction activity in the oil & gas and mining sectors, mainly benefitting US, Australia, Canada and Latin America-based construction companies.

While the overall credit quality of the global construction industry is stable, company-specific factors such as project execution issues, stressed liquidity, upcoming refinancing needs, or governance will continue to constrain the credit worthiness of some deeply speculative-grade issuers like Astaldi S.p.A. (Caa2 negative), Odebrecht Engenharia e Construcao S.A. (Caa2 negative) and Andrade Gutierrez Engenharia S.A. (Caa2 stable).

Main Conclusions

- Revenue will grow fastest in Asia Pacific and North America with rates of up to 10% and 6%, respectively. In the US and Canada, still healthy residential and a pickup in commercial construction activity will drive volumes as government funding schemes and increased commodity sector spending come into play.

- Moody's expects companies' credit quality overall to be stable across the sector in 2019. This is underpinned by the stable outlooks on ratings for 89% of the construction companies that it rates globally. However, company-specific factors such as project execution issues, stressed liquidity, upcoming refinancing needs, or governance will continue to constrain the credit quality of some deeply speculative-grade issuers.

- What could change the outlook. The outlook has been stable since 2017 when Moody's initiated the report series. It would consider changing the outlook to positive if there were signs that organic revenue growth would exceed 6% over the next 12 to 18 months and the order backlog would continue to grow (indicated by a book-to-bill ratio consistently above 1.25x), while operating margins remained at least stable. This could be driven by higher infrastructure spending and an acceleration in existing construction works. Conversely, Moody's would consider changing its outlook to negative if there were signs of organic revenue declining over the next 12 to 18 months and shrinking order backlogs (book-to-bill ratio less than 1.0x). This could be driven by lower infrastructure spending and a slowdown of existing construction works.