The August employment report showed the economy again adding back jobs at a strong rate. The reported gain of 1,371,000 somewhat overstates underlying strength since it includes the addition of 238,000 temporary Census jobs. However, even without these jobs, the gain would still be over 1.1 million. The unemployment rate dropped 1.8 percentage point to 8.4%, while the employment-to-population ratio (EPOP) rose 1.4 percentage point to 56.5%. (The Bureau of Labor Statistics warns that due to misclassification, the unemployment rate may actually be 0.7 percentage points higher than reported. The size of this error is considerably lower than in April or May, but comparable to its July level.)

The hit from the pandemic continues to skew to the more disadvantaged groups in the labor market. The unemployment rate for whites fell by 1.9 percentage points to 7.3%, while for Blacks it dropped 1.6 percentage points to 13.0%. Hispanics fared somewhat better with a drop of 2.4 percentage points to 10.5%. Since the April peak, white unemployment is down 6.9 percentage points, while Black unemployment is down by 3.8 percentage points from a peak in May. Hispanic unemployment has fallen 8.4 percentage points from its peak. Asian unemployment is extraordinarily high at 10.7%, down by just 4.3 percentage points from the May peak. The unemployment rate for Asians is typically comparable to or lower than whites.

By education, the unemployment rate for college grads stands at 5.3%, compared to 9.8% for those with just a high school degree. That compares with year-ago rates of 2.1% and 3.6%, respectively. For those with some college it is 8.0%.

One disturbing part of this picture is a sharp drop in the share of the unemployed who report being on temporary layoff from 56.4% to 45.5%. This is partly due to these workers getting their jobs back, but also due to many layoffs becoming permanent. Still, it is encouraging that close to half of the unemployed expect to be returning to their former jobs.

In this respect, it is striking that the number of people who report being self-employed is actually up from the year ago level. While the number of unincorporated self-employed is down slightly from 9,681,000 to 9,603,000, the number of incorporated self-employed, who are generally viewed as more established, rose by 178,000 to 6,327,000.

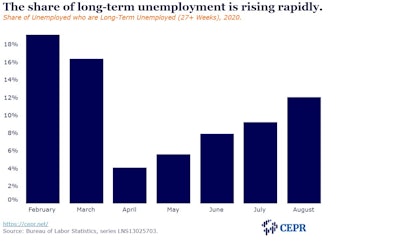

On the less encouraging side, the share of long-term unemployed (more than 26 weeks) rose from 9.2% to 12.0%. Historically, the long-term unemployed have had far more difficulty finding new employment.

Job Gains and Losses by Industry

The biggest job gainers by industry were ones that had been hit hard by the shutdowns. Retail added 248,900 jobs, accounting for almost a quarter of the private sector job growth. Employment in the sector is now 655,400 (4.2%) below the February level. Restaurants added 133,600 jobs, but industry employment is still down by almost 2.5 million (20.2%) from the pre-pandemic level.

Employment services added 126,300 jobs, but that still left employment down by more than 550,000 (15.1%) from the February level. Health care added 75,300 jobs, leaving employment down by more than 700,000 (4.3%) from February levels. Private educational services added 56,900 jobs, possibly due to efforts to cope with remote learning.

There was surprisingly weak job growth in some areas. Hotels added just 15,400 jobs, leaving employment more than 780,000 (37.3%) below the February level. Job growth in construction and manufacturing was also surprisingly weak, adding 16,000 and 29,000 jobs, respectively. Compared to February, construction employment is down by 425,000 (5.6%), while manufacturing employment is down by 720,000 (5.6%).

Job growth in construction and manufacturing was also surprisingly weak, adding 16,000 and 29,000 jobs, respectively.

The airline industry added back just 7,500 jobs in August, leaving employment down more than 100,000 (21.1%) from February. The movie industry added 13,900 jobs, but employment is still down by almost 230,000 (50.0%) from February’s level. Personal and laundry services added 13,900 jobs, leaving employment down by 288,000 (18.7%) from February.

State government employment fell by 2,000, while local government employment rose 95,000. Employment in these sectors is down, respectively, by 218,000 (4.2%) and 909,000 (6.2%). Since much government employment is in education, and therefore highly seasonal, it is difficult to make too much of the monthly changes at the end of the summer, but it is virtually certain we will see more layoffs if additional federal money is not forthcoming.

On the whole, this is a positive report, with the addition of more than 1 million private sector jobs, but we are still down 10.7 million from the February level, having recovered less than half the April job loss. With momentum clearly slowing and large public sector layoffs looming, it is difficult to be too optimistic.