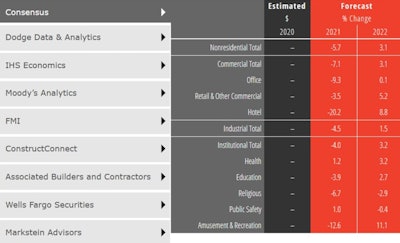

While the construction market held up surprisingly well in the second half of 2020, with only modest declines expected, design activity at architectural firms for new building construction projects continued to weaken, pointing to the potential for further dips in construction activity in 2021. This weakness will contribute to a projected 5.7% decline in overall construction spending, according to a new consensus forecast from the American Institute of Architects (AIA). However, a recovery is anticipated in 2022, with virtually all major building segments projected to see increases.

According to the report, “The AIA’s Architecture Billings Index (ABI), which measures revenue trends at US architecture firms, recorded a decline starting last March and has seen additional declines in every subsequent month. Given that AIA research has demonstrated that the ABI leads nonresidential construction spending by an average of nine to 12 months, construction activity in 2021 is projected to be weak.”

Consequently, the AIA Consensus Construction Forecast Panel, comprised of leading economic forecasters, projects steep declines in 2021 in construction spending on office buildings (down over 9%), hotels (down 20%) and amusement and recreation centers (down almost 13%). Health care and public safety are the only major sectors expected to see gains for the year.

To stimulate economic growth and subsequent construction activity, the report points to needed government support. “The December jobs report confirmed that the economy needs additional support in order to move to a sustainable economic expansion,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. While the most recent COVID-19 relief package passed last month offers some measure of optimism, the incentives included “weren’t designed to provide sufficient support for an extended period of economic weakness.”

While overall construction activity is expected to decline this year, there are bright spots seen in the ongoing strength in the residential construction market as well as the retrofit sector. “Many existing commercial and institutional facilities need significant modifications to accommodate a post-pandemic staff and client base, and much of this activity is not included in the construction spending figures,” the report indicates.

And despite the general pessimism surrounding 2021, the panel is currently projecting 3% gains in 2022 for the overall building market, matched by the commercial and institutional sectors. “As pandemic concerns begin to wane and economic activity begins to pick up later in 2021, there is likely to be considerable pent-up demand for nonresidential space, leading to anticipated growth in construction spending in 2022,” said Baker.

Complete details on the latest Consensus Construction Forecast can be found on AIA’s website