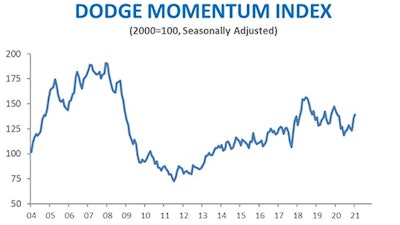

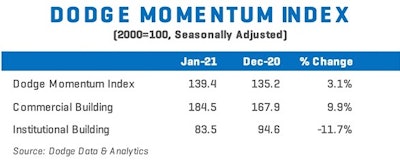

The Dodge Momentum Index – a monthly measure of the first (or initial) report for nonresidential building projects in planning issued by Dodge Data & Analytics – has been on a roller coaster ride since its steep tumble at the start of the COVID-19 pandemic in early 2020, albeit trending steadily back upward throughout the year. Now, after jumping 9.2% in 2020's final month, it is starting 2021 on a positive note, with a 3.1% increase, rising to 139.4 (2000=100) from the revised December reading of 135.2.

According to the report, there were 13 projects entering planning that had a value of $100 million or more, most notably the:

- $420 million Walmart distribution center in Lancaster, TX;

- $355 million Amazon warehouse (Project Roxy) in Arlington, WA;

- $175 million Norman Regional Healthplex expansion in Norman, OK;

- and $156 million Mercy Health Hospital in Kings Mills, OH.

While January marked the highest level for the Momentum Index since March 2020, the roller coaster recovery is expected to continue, with the two components measured remaining uneven in their progress. As Dodge Data points out, institutional planning hit its lowest level since the Momentum Index began in 2002, as state and local governments pulled back on building plans in the face of growing budget deficits; while commercial planning reached its highest level since before the Great Recession, fueled by an increasing number of warehouse projects, as well as office projects to a somewhat lesser degree.

And though it continued to trend upward over the course of 2020, the overall Momentum Index remains 2.2% below January 2020's level. The commercial component is up 12.3% year-over-year, but the institutional component is down a substantial 27.7%. Both sectors will need to see sustained planning growth before a full recovery to pre-pandemic level construction spending becomes more likely.

Information provided by Dodge Data & Analytics and edited by Becky Schultz.