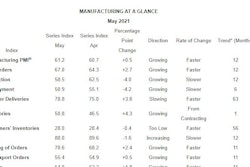

Engineering and construction costs maintained their upward movement in May, driven at least in part by rising costs to ship materials from key markets to the U.S. The latest IHS Markit PEG Engineering and Construction Cost Index (ECCI), produced jointly by IHS Markit and the Procurement Executives Group (PEG), shows costs rose for the seventh straight month, with survey respondents reporting widespread price increases across all index components.

As a result, the ECCI moved up 6.3 points to a 78.8 reading in May. The materials and equipment sub-index saw its sixth consecutive monthly increase, rising 4.6 points to 83.1. The subcontractor labor index came in at 68.6, up 10.3 index points from April.

IHS Markit

IHS Markit

All other categories saw further price expansion. Copper prices rose for the eleventh straight month, reaching an index level of 87.5, the highest since January. Costs of ocean freight from both Europe and Asia to the U.S. expanded for the ninth month in a row, with an index figure of 83.3.

“The China containerized freight index has been sitting at a level greater than 1,000 since the fourth quarter of 2020, having last breached the four-digit mark more than five years ago,” said Tal Dickstein, senior economist at IHS Markit. “The continued high volumes along this route indicate that demand remains strong. At the same time, we are entering a seasonally high demand period, as well, meaning tightness will continue over the summer and prices will remain elevated.”

Most survey respondents did not report any shortages for materials and equipment beyond the restrictions due to shipping.

Not surprising given widespread reports of labor shortages, the current subcontractor labor costs sub-index rose for the fourth straight month, showing a double-digit increase from April's 58.3 index level to 68.6 in May. Survey respondents report rising labor costs for sub-indices representing each region of the U.S. and Canada.

The six-month headline expectations for future construction costs index reached 70.4 in May, showing respondents’ expectations of continued price increases into the latter part of 2021. While the index for the materials and equipment component came in at 69.3, expectations for ongoing labor cost increases in all regions of the U.S. and Canada pushed the sub-index for current subcontractor labor costs to a reading of 73.0.

The ECCI is based upon data independently obtained and compiled by IHS Markit from procurement executives representing leading engineering, procurement and construction firms. It tracks industry-specific trends and variations, identifying market turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to this construction and engineering industry. To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

Information provided by IHS Markit and edited by Becky Schultz.