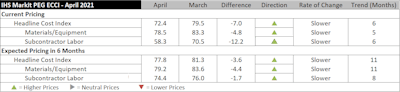

Costs for engineering and construction materials rose for the sixth consecutive month in April, pushing the headline IHS Markit PEG Engineering and Construction Cost Index (ECCI) downward to 72.4, a 7.0-point decline from the March figure.

Produced by IHS Markit and the Procurement Executives Group (PEG), the ECCI is based upon data independently obtained and compiled by IHS Markit from procurement executives representing leading engineering, procurement and construction firms. It tracks industry-specific trends and variations, identifying market turning points for key projects, and is intended to act as a leading indicator for wage and material inflation specific to this construction and engineering industry.

According to the latest ECCI findings, the materials and equipment portion of the index saw a fifth straight month of price increase, causing it to fall 78.5 (-4.8 from March), while the subcontractor labor index dropped 12.2 points to 58.3.

For the fourth month in a row, participants in the April survey indicated increases for all categories under the materials and equipment sub-index. Costs of ocean freight from both Europe and Asia to the U.S. rose for the eighth consecutive month, reaching a total of 95.0 (+ 6.1 index points from March). Most other categories saw declines in index totals indicating price increases were not as widely felt in April. Transformer prices recorded their fifth straight month of price increases, with the index falling to 72.7 (-4.6 points). Copper prices climbed for the ninth month in a row, causing the index figure to plummet to 78.6 from March's 91.7.

The alloy steel pipe price index rose just 1.3 index points to 84.6 in April, but costs for steel inputs are expected to continue to go up. “Steel pipe prices will continue to rise throughout the second quarter, reflecting strength in buying activity as well as surging steel input costs,” Amanda Eglinton, associate director, IHS Markit, forecasts. “The extent of the price increases will vary significantly across products and geographies, with increases in the United States exceeding those in most other economies. The strong increases in input costs mean that suppliers are still seeing their margins squeezed despite increasing prices to buyers, providing little room for negotiation on buys.”

Labor costs actually came in significantly lower compared to March. Survey responses show the sub-index for current subcontractor labor costs at 58.3 in April, down substantially from 70.5 in the prior month. Labor costs rose in all regions of the U.S. and in Canada. However, the sub-indexes in all reporting regions were much lower for the month, signaling cost pressures were less widespread in April.

The six-month expectations for future construction costs index came in at 77.8 in April, indicating expectations of continued price increases through the second and third quarters of 2021, IHS Markit reports. Both the materials and equipment sub-index totaled 79.2 for the month, while the six-month expectations index for subcontractor labor saw an index reading of 74.4, as labor costs are expected to continue to increase in all U.S. and Canadian regions.

Most survey respondents did not report any shortages for materials and equipment, other than some transient supply constraints due to shipping.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

Information provided by IHS Markit and edited by Becky Schultz.