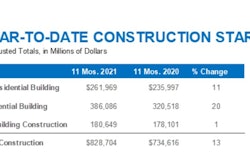

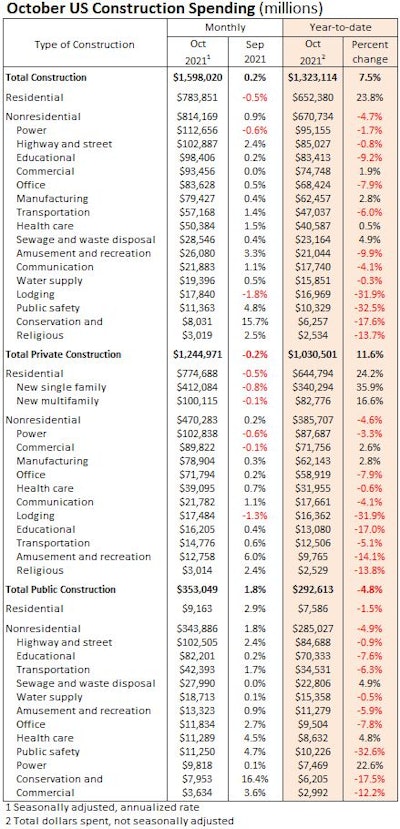

Total construction spending rose 0.2% during October. Actual construction outlays year-to-date (total dollars spent, not seasonally adjusted) are 7.5% greater than the first 10 months of 2020. Click on this table to enlargedata: US Department of Commerce; graph: ForConstructionPros.com

Click on this table to enlargedata: US Department of Commerce; graph: ForConstructionPros.com

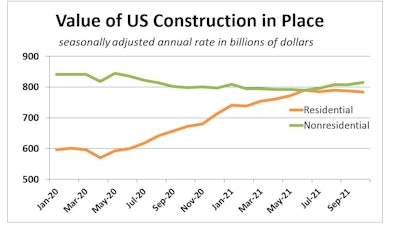

A major theme of the past year and a half has been the divergence in residential and nonresidential activity owed largely to the lingering pandemic. Now, with vaccines and an expanding toolbox of therapeutics, the late-pandemic economic picture is coming into sharper focus and residential and nonresidential construction spending appears to be moving back toward their respective, normal trend lines. Residential spending slipped 0.5% during October, the once meteoric market now in its fourth month of easing. Despite strong buyer demand and dwindling inventories of existing homes, persistent shortage of materials and labor in a substantially higher-cost environment have forced builders to tap the breaks on new development.

Nonresidential outlays rose 0.9% in October, the fourth straight month spending has either been flat or improved.

“Nonresidential sectors suffering the most acute impacts from the pandemic are still struggling to get back on track, notably for new office, hotel, education and healthcare projects,” said Mark Vitner, senior economist with Wells Fargo Securities. “That said, the knock-on effects of the pandemic continue to be a boon for new warehouse development. Demand for retail space has also improved, as consumers have more time to shop given more flexible work schedules. Manufacturing outlays have also firmed, as many producers are looking to boost capacity.”

October spending was up in 13 of the 16 nonresidential subcategories, with the commercial subcategory virtually unchanged. Private nonresidential spending was up slightly by 0.2%, while public nonresidential construction spending increased 1.8% in October.

Increased activity or prices?

“On the surface, there is much to be encouraged by in October’s construction spending data,” said Associated Builders and Contractors’ Chief Economist Anirban Basu. “Nonresidential spending is now at its highest level since July 2020 and has rebounded 3.1% since bottoming out in June 2021. Nonresidential spending expanded meaningfully for the month and those gains were spread across most subsectors. Data characterizing the two prior months were upwardly revised by a combined $27 billion, or 1.7%.

“But construction data do not adjust for inflation, and these spending gains are largely attributable to increases in the cost of delivering construction services. Challenges that have suppressed nonresidential construction spending growth remain firmly in place. While lofty levels of investment in real estate would normally be associated with significant private construction volumes, many project owners have been induced to postpone projects because of elevated material and labor costs as well as widespread shortages.”

Shortages of key building materials have pulled prices sharply higher for a wide array of items ranging from steel and copper to appliances and pick-up trucks. Labor shortages have added to the rising cost environment and upset choreographed project schedules, leading to delays and uncertain completion timelines.

“Still, leading indicators remain positive,” said Basu. “ABC members collectively expect revenues and employment levels to climb during the months ahead, according to ABC’s Construction Confidence Index. Design work is plentiful, which means that many investors are at least considering moving forward with projects. In certain geographies, especially in the southern United States, office and other segments are improving, which should translate into more abundant construction starts once global supply chains and materials prices normalize.”

According to Dodge Data & Analytics, total nonresidential building starts shot up 29% in October and starts are up 11% year-to-date. The forward-looking American Institute of Architects’ Architecture Billings Index has been solidly in expansion territory for nine straight months. The recently enacted Infrastructure Investment & Jobs Act, provides $550 billion of new spending for roads, bridges, mass transit, water and numerous other infrastructure projects, but the bulk of that spending will not materialize for a year or more.

What’s next?

Single-family spending dipped 0.8% during the month, and multifamily outlays slid 0.1%. But actual residential construction spending year-to-date is 23.8% above the 2020 level.

“Buyer demand remains strong, as evidenced by a 7.5% jump in pending home sales during October and a similarly strong gain in mortgage applications for purchase during November,” said Vitner. “However, builders appear to be tapping the brakes as supply-side challenges wreak havoc on project timelines. There is a growing pipeline of single-family homes currently under construction, many of which are awaiting key components in order to be completed.”

Both single-family and multifamily permits activity increased in October, though.

“Lofty level of multifamily permitting recently suggests developers are encouraged by the broad-based resurgence in demand for apartments and are planning to push through the supply headwinds,” said Vitner. “A large proportion of apartment development is in mid-rise and high-rise projects.”

“It is encouraging to see such a broad-based pickup in spending on nonresidential projects in the latest month,” said Ken Simonson, the Associated General Contractors' chief economist. “But the construction industry still faces major challenges from workforce shortages and supply-chain bottlenecks.”

Spending on many categories of public construction is likely to increase soon as the investments from the federal infrastructure act begin to flow. But AGC officials underscore that supply chain challenges and labor shortages were impacting construction schedules and budgets and prompting some owners to delay or cancel projects. They urged the Biden administration to explore new ways to relieve shipping delays and invest more in career and technical education programs that serve as a pipeline into construction careers.

“Getting a handle on supply chains and encouraging more people to work in construction will go a long way in helping this industry recover,” said Stephen E. Sandherr, the association’s chief executive officer.

The COVID-19 infections ramping up in recent weeks and emergence of the omicron variant add a layer of uncertainty and may prevent certain materials and equipment prices from declining in the very near term. But strong fundamentals are in place.

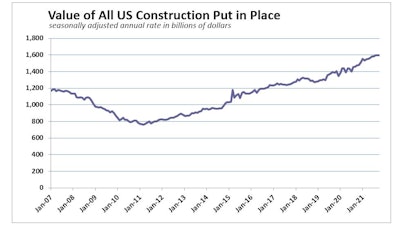

“The bottom line is that 2022 should be an excellent year for nonresidential construction,” said Basu. “Performance will be led by public construction, especially in the context of a recently passed and large infrastructure package. Among the segments that are set to zoom ahead are roads and bridges, school construction, water systems, airports, seaports and rail. Traditional office and lodging construction will likely remain weak in much of the nation, however.” data: US Department of Commerce; graph: ForConstructionPros.com

data: US Department of Commerce; graph: ForConstructionPros.com