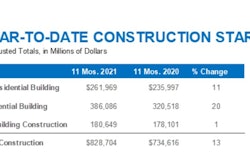

Workforce shortages, supply chain disruptions and construction cost increases continued to rear their ugly head in the fourth quarter of 2021, shifting the U.S. Chamber of Commerce Commercial Construction Index (Index) down one point to 65. Contractors’ revenue expectations, a key driver of the overall Index score, fell for the first time since the start of the pandemic to 58, the Chamber reports, dipping three points from the third quarter.

The Chamber's quarterly economic index is designed to gauge the outlook for, and resulting confidence in, the commercial construction industry based on three leading indicators – revenue, new business confidence and backlog – measured on a scale of 0 to 100. The Q4 Index saw negative in the revenue outlook and confidence despite growing positivity toward construction backlogs.

- Contractors’ revenue expectations over the next 12 months fell to 58 (down three points from Q3 2021).

- The overall level of contractor confidence fell to 63 (down one point from Q3 2021).

- The ratio of average current to ideal backlog rose three points to 75 (up one point from Q3 2021).

Labor Shortage and Costs Drive Pessimism

U.S. Chamber of Commerce Executive Vice President and Chief Policy Officer Neil Bradley attributes the negativity in large part to workforce challenges. He describes the worsening worker shortage as “one of the most pressing issues facing our economy today” for most industries, but particularly in construction.

“The vast majority (91%) of contractors report moderate to high levels of difficulty finding skilled labor, up three points from this summer,” the Chamber indicates. “More telling is the fact that 62% of contractors report high levels of difficulty finding skilled workers, rising seven points from last quarter, and up 20 points from one year ago.”

A recent analysis by the Associated General Contractors of America (AGC) showed only a third of U.S. states added construction jobs from February 2020 through October of this year, despite record demand. “The record number of job openings shows contractors are eager to hire more workers but can’t find enough qualified applicants,” commented Ken Simonson, AGC chief economist.

The consequences have been dire, with almost half (45%) of Index respondents indicating they have been forced to turn down work due to the inability to find enough workers. As a whole, contractors have faced steep wage increases in 2021, with JLL forecasting further increases in the 3% to 6% range in 2022.

Materials Prices and Availability Hinder Growth

The supply chain disruptions of 2021 have also proven especially challenging for the construction market. In Q4, the Index shows a record-high percentage (95%) of contractors experienced at least one product shortage, up two points from 93% in Q3, and up 24 points year over year. Steel continued to be the most reported product shortage at 27%, followed by roofing material (19%) and wood/lumber (17%).

Overall, construction input prices rose 1.4% in November and are up 23.5% from a year ago level, according to an Associated Builders and Contractors (ABC) analysis. Nearly all product categories have been affected.

“Prices for nearly every type of construction material are rising at runaway rates,” stated AGC’s Simonson. “These costs are compounding the difficulties contractors are experiencing from long lead times for production, gridlocked supply chains and record numbers of job openings.”

Not surprisingly, concern regarding the cost of materials remains near an all-time high (since inception of the Index in 2017), with 97% of contractors indicating cost fluctuations have had a moderate to high impact on their business, the Chamber notes. Of these, 43% cite steel as their primary concern.

The number of contractors reporting negative impacts from material costs is up 23 points year over year. And there appears to be little relief in sight.

“There is no indication that materials prices will fall in the near future," said ABC Chief Economist Anirban Basu. “With the omicron variant now circulating around the world and leading to a next wave of lockdowns and supply chain disruptions, demand for key commodities will continue to exceed supply. Among the implications is that estimators will be under enormous pressure to predict materials prices amid enormous volatility and uncertainty.”

Tariffs Add to Supply and Cost Concerns

Further complicating pricing and availability is the fact that tariffs on specific but critical goods remain in place. According to the Index, nearly half (47%) of contractors said steel and aluminum tariffs will have a high to very high degree of impact on their business in the next three years. A similar percentage (49%) said the same about new construction material and equipment tariffs, up five points from Q3 and 23 points year over year.

While a deal was reached between the U.S. and European Union in late October which removed a renewed threat of tariffs on steel and aluminum imported from Europe, restrictions continue for other global regions, and tariffs on other goods used in the construction process remain largely in effect. The result has been further pressure on both pricing and availability.

Consequently, the U.S. Chamber of Commerce is urging the federal government to take actions that can provide relief to construction business owners.

“It is critical that policymakers invest in programs to upskill and prioritize workers, pass sensible immigration reform and remove tariffs and other trade barriers,” said Bradley, “so that contractors have the workers and materials they need to get the job done.”