Associated Builders and Contractors (ABC) today released its newest construction industry economic measure, the Construction Confidence Index (CCI). The CCI is a diffusion index that reflects three aspects of the U.S. nonresidential construction industry - sales prospects, staffing levels and profit.

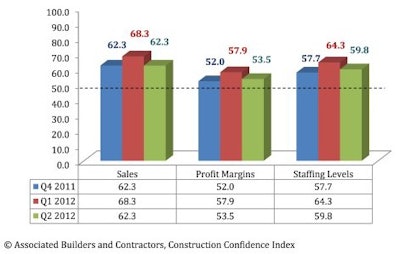

During the second quarter of 2012, all three indices declined, undoing much of the first quarter’s progress and indicating that nonresidential construction momentum is waning. However, index values remain above 50, indicating that construction spending is still poised to expand, just at a slower pace. CCI is a diffusion index. Like many of these indices, readings above 50 are favorable and indicate growth, while readings below 50 are unfavorable.

- Sales expectations fell from 68.3 to 62.3

- Profit margins fell from 57.9 to 53.5

- Staffing levels fell from 64.3 to 59.8

"Despite data indicating that the nation is now in its fourth year of economic expansion, the nonresidential construction industry continues to struggle to establish sustained momentum,” said ABC Chief Economist Anirban Basu. “In recent months, nonresidential construction spending levels have barely managed to edge higher, disappointing many contractors. "

“Nonresidential construction firms have become unnerved by the possibility of the nation falling off a fiscal cliff - due to a number of tax increases and spending cuts that take effect at the end of the year - leading the economy back into recession in 2013,” Basu said. “This would limit private nonresidential construction, which is among the nation’s most cyclical industries.

“A recession also would hammer away at already weak federal, state and local government finances, likely leading to further declines in public spending,” said Basu. “For contractor attitudes to improve further, it likely will take some resolution of the fiscal cliff and positive economic data,” Basu said.