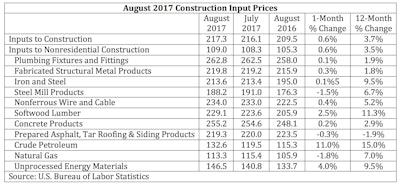

Construction input prices rose 0.6% in August and are up 3.7% on a yearly basis, according to an Associated Builders and Contractors (ABC) analysis of the Bureau of Labor Statistics data. Nonresidential construction input prices behaved similarly, rising 0.6% for the month and 3.5% for the year.

Only three of the 11 key construction input prices fell for the month. The inputs experiencing declines in prices were steel mill products (-1.5%), prepared asphalt, tar roofing and siding products (-0.3%), and natural gas (-1.8%). Crude petroleum prices exhibited the largest increase, rising 11% on a monthly basis and 15% on an annual basis.

Steel mill products; prepared asphalt, tar roofing and siding products; and natural gas all experienced input price decreases while crude petroleum prices exhibited the largest increase for August.

Steel mill products; prepared asphalt, tar roofing and siding products; and natural gas all experienced input price decreases while crude petroleum prices exhibited the largest increase for August.

“If we consider what ought to be happening with respect to materials prices, we would expect them to be marching steadily higher,” said ABC Chief Economist Anirban Basu. “After all, the global economic recovery is an increasingly synchronized one. China is on pace to meet growth expectations this year. Europe, Japan, Brazil, Russia and other nations are experiencing meaningfully better recoveries this year compared to 2016. While some economies like Great Britain’s and India’s have stumbled a bit lately, the broader story is one of more rapid global economic growth, driven in large measure by a low interest rate, post-austerity policy environment.

“The world’s improving global economic environment has helped stabilize demand and prices for various commodities. As a result, we are not observing the sharp declines in input prices that occurred during much of 2014 and 2015,” said Basu. “Demand for materials in the United States also remains reasonably high, given ongoing momentum in a number of private segments and indications of stable activity among road builders. The fact that asset prices have been rising, including in key global equity markets, has contributed to pushing materials prices higher, with positive wealth effects triggering greater confidence among real estate developers.

“For now, policymakers around the world appear focused on supporting economic growth. While this may ultimately translate into problematic global inflation, for now inflation remains under control,” said Basu. “That suggests that accommodative monetary policy will continue to remain in place in much of the world, which will support asset prices, economic growth and demand for construction materials. While surging construction materials prices are unlikely during the near term, with the exception of areas recently impacted by Hurricanes Harvey and Irma, so too are large declines.”