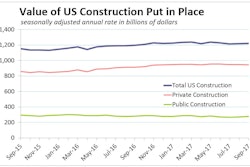

Overall construction spending increased between September 2016 and September 2017 as growing private-sector residential demand continues to offset annual declines in public-sector investments in infrastructure and other projects, according to an Associated General Contractors of America analysis of new government data.

Association officials urged members of Congress and the Trump administration to include new funding for roads, bridges, clean water and other important infrastructure as part of any new tax reform measure.

“The ongoing economic expansion is a favorable sign for private residential and nonresidential construction,” said Ken Simonson, the association's chief economist. “But lawmakers continue to underfund public investment.”

Construction spending in September totaled $1.219 trillion at a seasonally adjusted annual rate, an increase of 0.3% from the August total and up 2% from a year earlier, Simonson said. He noted that while a good number of categories had gains for the year, total spending on manufacturing, water systems, highway and street and commercial construction experienced significant declines for the year.

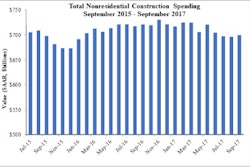

Private nonresidential spending declined by 0.8% in September and was 3.8% below the September 2016 level. The largest private nonresidential segment was power construction (including oil and gas field and pipeline projects), which declined by 1.4% for the month and 9.1% from September 2016 to September 2017.

The next-largest segment, commercial (retail, warehouse and farm) construction, fell 1% for the month but is up 11.7% year-over-year. Manufacturing construction dropped by 3.6% for the month and 20.5% from a year earlier. Private office construction decreased 1.1% from August and by 7.4% since September 2016.

Public construction spending climbed 2.6% from the prior month but is down by 1.6% from September 2016 to September 2017. Highway and street construction increased 1.1% for the month as more state funding initiatives came online but is down 7.4% from a year earlier. Among other major public infrastructure categories, spending on transportation facilities such as transit and airport construction rose 5% for the month but slipped 1% year-over-year; spending on sewage and waste disposal fell by 0.1% and 9.7%, respectively; and spending on water supply dropped 0.4% in September and 8.3% year-over-year. Public educational construction was up 5.2% in September and up 6% over 12 months.

Private residential construction spending was flat between August and September but is up 9.6% over the year. Spending on multifamily residential construction grew 0.6% in September and 0.9% from a year ago, while single-family was up 0.2% for the month and 11.9% from the September 2016 rate.

Association officials said the fact public sector investments in construction remain down for the year despite overall robust economic growth means maintenance and improvements will lag even as greater economic activity puts more wear on roads, bridges and other public works. They said Congress and the President have a great opportunity to improve infrastructure by including new investments as part of the pending tax reform measure.

“Done right, tax reform will make it easier for the private sector to thrive and finance needed improvements to the public works that support out economy,” said Stephen E. Sandherr, the association’s chief executive officer.