Caterpillar Inc. announced first quarter 2019 sales and revenues of $13.5 billion, compared with $12.9 billion in the first quarter of 2018, a 5% increase. First quarter 2019 profit of $3.25 per share was a first quarter record. This was a 19% increase compared with the previous record first-quarter profit per share of $2.74 in 2018.

Profit per share in the first quarter of 2019 included a discrete tax benefit related to U.S. tax reform of $178 million, or $0.31 per share. Profit per share in the first quarter of 2018 included restructuring costs of $0.08 per share.

“The global Caterpillar team delivered record first-quarter profit per share,” said Caterpillar Chairman and CEO Jim Umpleby. “We are executing our strategy for profitable growth by investing in services, expanding our offerings and improving operational excellence.”

The company continues to have confidence in the fundamentals of its diverse end markets, and expectations for 2019 performance are unchanged. However, due to a $0.31 per share discrete tax benefit, Caterpillar is revising its profit per share outlook to a range of $12.06 to $13.06, compared with the previous outlook range of $11.75 to $12.75.

Consolidated Results

Total sales and revenues of $13.466 billion in the first quarter of 2019 increased $607 million, or 5%, compared with $12.859 billion in the first quarter of 2018. The increase was primarily due to higher sales volume driven by improved demand for both equipment and services, with the most significant increase in Resource Industries. Sales volume also increased in Construction Industries, while Energy & Transportation was about flat.

Sales grew in all regions except for EAME, with the largest gains in North America and Asia/Pacific. Favorable price realization, primarily in Construction Industries and Resource Industries, also contributed to the sales improvement. The increase was partially offset by unfavorable currency impacts due to a stronger U.S. dollar.

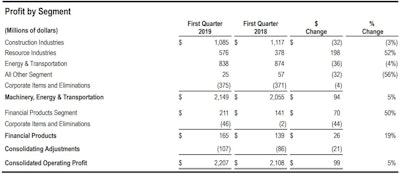

Operating profit for the first quarter of 2019 was $2.207 billion, compared with $2.108 billion in the first quarter of 2018. The increase of $99 million was mostly due to favorable price realization and higher sales volume, partially offset by higher manufacturing costs and increased selling, general and administrative (SG&A) and research and development (R&D) expenses.

Operating profit margin was 16.4% for the first quarter of 2019 and 2018.

At the end of the first quarter of 2019, the order backlog was $16.9 billion, about $300 million higher than the fourth quarter of 2018. The increase was in Construction Industries and Energy & Transportation, partially offset by a decrease in Resource Industries due to higher dealer inventories.

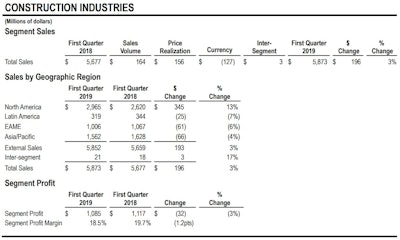

Construction Industries

Construction Industries’ total sales were $5.873 billion in the first quarter of 2019, compared with $5.677 billion in the first quarter of 2018. The increase was mostly due to higher end-user demand for construction equipment, partially offset by a smaller increase in dealer inventories compared with the first quarter of 2018. Favorable price realization was partially offset by unfavorable currency impacts due to a stronger U.S. dollar.

- In North America, the sales increase was driven by higher demand for new equipment, primarily to support road construction activities. Favorable price realization also contributed to the sales improvement.

- Construction activities remained at low levels in Latin America.

- In EAME, the sales decrease was primarily due to a smaller increase in dealer inventories compared with the first quarter of 2018, and a weaker euro, partially offset by favorable price realization.

- Sales in Asia/Pacific declined due to unfavorable currency impacts.

Resource Industries

Resource Industries’ total sales were $2.727 billion in the first quarter of 2019, an increase of $418 million from the first quarter of 2018. The increase was primarily due to higher equipment demand, favorable price realization and services.

Mining production levels and commodity market fundamentals remained positive, which supported higher sales. Higher demand levels for non-residential construction activities and quarry and aggregate operations also drove higher sales.

Resource Industries’ profit was $576 million in the first quarter of 2019, compared with $378 million in the first quarter of 2018. The improvement was mostly due to higher sales volume.

Energy & Transportation

Energy & Transportation’s total sales were $5.210 billion in the first quarter of 2019, about flat compared with $5.219 billion in the first quarter of 2018. Decreases due to unfavorable currency impacts from a stronger U.S. dollar were nearly offset by favorable price realization and higher sales volumes.

- Oil and Gas – Sales were negatively impacted by the timing of turbine project deliveries in North America. The decrease was partially offset by higher demand for reciprocating engines for gas compression in North America.

- Power Generation – Sales increased primarily due to higher shipments for large diesel reciprocating engine applications in all regions except EAME.

- Industrial – Sales were about flat, with a decrease in EAME primarily due to unfavorable currency impacts nearly offset by higher sales in North America.

- Transportation – Sales were slightly lower primarily due to unfavorable currency impacts.

Energy & Transportation’s profit was $838 million in the first quarter of 2019, compared with $874 million in the first quarter of 2018. The decrease was partially offset by favorable price realization and higher sales volume.

Financial Products

Financial Products’ segment revenues were $850 million in the first quarter of 2019, an increase of $57 million, or 7%, from the first quarter of 2018. The increase was primarily due to higher average financing rates and higher average earning assets in North America and Asia/Pacific.

Financial Products’ segment profit was $211 million in the first quarter of 2019, compared with $141 million in the first quarter of 2018. The increase was primarily due to a $42 million favorable impact from mark-to-market on equity securities in Insurance Services, an increase in net yield on average earning assets and a decrease in the provision for credit losses at Cat Financial.

Caterpillar Reports Fourth Quarter and Full-Year 2018 Results