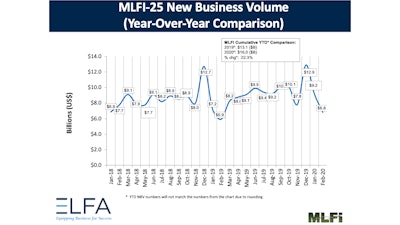

The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity from 25 companies representing a cross section of the $900 billion equipment finance sector, showed their overall new business volume for February was $6.8 billion, up 15% year-over-year from new business volume in February 2019. Volume was down 26% month-to-month from $9.2 billion in January. Year-to-date, cumulative new business volume was up 22% compared to 2019.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in March is 46.0, a decrease from the February index of 58.7.

ELFA President and CEO Ralph Petta said, “The robust volume data captured in the February MLFI-25 will no doubt take a turn in succeeding months as the Coronavirus pandemic puts a damper on business growth and expansion and equipment acquisition plans. In addition, portfolio quality—rising delinquencies and write-offs—will suffer as economic activity slows resulting in some lessees/obligors experiencing challenges meeting their payment obligations. The association is closely monitoring these marketplace developments, gauging the effect of changes in overall economic activity in the U.S. and, specifically, the impact to the equipment leasing and finance industry.”

Bruce J. Winter, President, FSG Capital, Inc., said, “The shock of the economic fallout arising from the COVID-19 pandemic is now the most important issue facing our office and clients each day. While optimism was high just one month ago, and portfolio performance outstanding, the devastation to client finances is quickly becoming apparent to all. Many new equipment financing opportunities have been put on hold, and our attention is focused on managing our portfolio to ensure customers get the support and attention needed in these unprecedented times. While it’s too early to measure the final consequences, and without the knowledge of when and how governmental support might help, we know this is a time where balance sheet strength matters. Following trends from past cycles, those entities with lightly capitalized businesses will be the first to fail, even with the support of government and lenders, and we believe those with the strongest balance sheets will ultimately prosper.”

About ELFA’s MLFI-25 The MLFI-25 is the only index that reflects capex, or the volume of commercial equipment financed in the U.S. The MLFI-25 is released globally at 8 a.m. Eastern time from Washington, D.C., each month on the day before the U.S. Department of Commerce releases the durable goods report. The MLFI-25 is a financial indicator that complements the durable goods report and other economic indexes, including the Institute for Supply Management Index, which reports economic activity in the manufacturing sector. Together with the MLFI-25 these reports provide a complete view of the status of productive assets in the U.S. economy: equipment produced, acquired and financed.

The MLFI-25 is a time series that reflects two years of business activity for the 25 companies currently participating in the survey. The latest MLFI-25, including methodology and participants, is available at www.elfaonline.org/Data/MLFI/.

MLFI-25 Methodology ELFA produces the MLFI-25 survey to help member organizations achieve competitive advantage by providing them with leading-edge research and benchmarking information to support strategic business decision making.

The MLFI-25 is a barometer of the trends in U.S. capital equipment investment. Five components are included in the survey: new business volume (originations), aging of receivables, charge-offs, credit approval ratios, (approved vs. submitted) and headcount for the equipment finance business.

The MLFI-25 measures monthly commercial equipment lease and loan activity as reported by participating ELFA member equipment finance companies representing a cross section of the equipment finance sector, including small ticket, middle-market, large ticket, bank, captive and independent leasing and finance companies. Based on hard survey data, the responses mirror the economic activity of the broader equipment finance sector and current business conditions nationally.