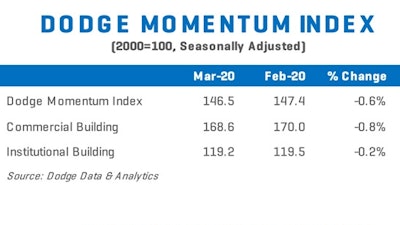

The Dodge Momentum Index declined by a scant 0.6% in March to 146.5 (2000=100) from the revised February reading of 147.4. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. The drop in March was present in both components of the Momentum Index – the commercial component fell 0.8%, while the institutional component was 0.2% lower.

What is unclear at this juncture, however, is whether projects will continue through the planning life cycle to the start stage at the same pace as before the pandemic began due to workforce issues, supply constraints or forced moratoriums on construction from local officials. Dodge will be monitoring the progress of the projects entering the planning process and will provide frequent updates as the crisis evolves.

Construction's Coronavirus Daily Update @ForConstructionPros.com

In March, 14 projects each with a value of $100 million or more entered planning. The leading commercial projects were a $459 million office building in Washington DC and a $300 million office building in Long Island City NY. The leading institutional projects were phases two and three of the Kaiser Permanente Moreno Valley Medical Center in Moreno Valley CA totaling $513 million.

Dodge Data & Analytics COVID-19 (Coronavirus) Resources: https://www.construction.com/toolkit

What Past Pandemics Suggest about Construction Economy’s Coronavirus Recovery