Wall Street is officially in a bear market, with the S&P 500 falling by nearly 30% since its February peak. The market plunged in response to global spread of infection of the Novel Coronavirus leading to COVID-19 – a disease with 40 times the mortality rate of the flu – a ban on travel from Europe to the U.S., and persistent uncertainty here about medical, social and fiscal response to the virus.

Zillow Research dived deep into data on the economic effects of past global pandemics to help provide perspective on what the future might hold under various scenarios.

Zillow reports the following patterns:

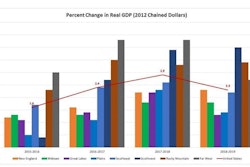

- During epidemics such as the 1918 influenza or 2003 SARS outbreaks, economic activity fell sharply during the epidemic (a 5-10% hit to GDP or industrial production during the epidemic) but snapped back quickly once the epidemic was over. A standard recession is a situation in which economic activity falls for 6 to 18 months and then recovers more slowly.

- During SARS, Hong Kong house prices did not fall significantly, but transaction volumes fell by up to 72% as customers avoided human contact. After the epidemic was over, transactions snapped back to normal volumes.

- During the current episode, early news reports indicate that home prices in China have so far not fallen but transactions have nearly ceased.

- During standard recessions, home prices and transaction volumes may fall but this is not always the case (e.g. the 2001 recession).

- Before February 2020, leading economic indicators (job openings, the yield curve, interest rate spreads, and sentiment indicators) were giving mixed signals about the risk of recession this year, with betting markets (PredictIt, 2020) giving probabilities of at least two consecutive quarters of falling GDP ranging from 30% in December 2019 to 15% in January 2020, rising to 44% as of March 1.

It is difficult to precisely forecast the probability of an epidemic-related downturn and/or how such a downturn could provoke a standard recession because this depends on how COVID-19 progresses and how this progress interacts with preexisting recession risks and policy responses ranging from doing nothing to shutting down entire cities for months at a time.