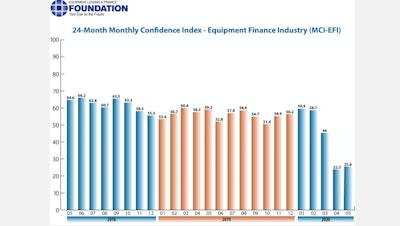

The Equipment Leasing & Finance Foundation (the Foundation) released the May 2020 Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI) today. The index reports a qualitative assessment of both the prevailing business conditions and expectations for the future as reported by key executives from the $900 billion equipment finance sector. Overall, confidence in the equipment finance market improved with an index of 25.8, up from the historic low in April of 22.3.

The Foundation also releases highlights of its newly launched COVID-19 Impact Survey of the Equipment Finance Industry, a monthly survey of industry leaders designed to track the impact of the coronavirus pandemic on the equipment finance industry. From 101 survey responses collected from May 4-8, results show that 93% of equipment finance companies have offered payment deferrals. A large majority (88%) of companies have not furloughed or laid off employees.

Comments from survey respondents follow MCI-EFI survey comments below, and additional survey results are available at https://www.leasefoundation.org/industry-resources/covid-impact-survey/.

When asked about the outlook for the future, MCI-EFI survey respondent Alan Sikora, CLFP, CEO, First American Equipment Finance, an RBC / City National Company, said, “While there is currently much uncertainty in the world, the U.S. equipment leasing and finance industry has a history of resiliency during times of crisis. We will get through this, and many companies will innovate and emerge stronger.”

May 2020 survey results

The overall MCI-EFI is 25.8, an increase from 22.3 in April.

When asked to assess their business conditions over the next four months:

- 3.3% of executives responding said they believe business conditions will improve over the next four months, down from 6.9% in April

- 10% believe business conditions will remain the same over the next four months, an increase from none the previous month

- 86.7% believe business conditions will worsen, a decrease from 93.1% in April.

Most respondents don't expect demand for leases and loans to fund capital expenditures (capex) to increase over the next four months.

- 6.7% of the survey respondents believe demand will increase over the next four months, relatively unchanged from April

- 6.7% believe demand will “remain the same” during the same four-month time period, an increase from 3.5% the previous month

- 86.7% believe demand will decline, a decrease from 89.7% in April

None of the respondents expect more access to capital to fund equipment acquisitions over the next four months, unchanged from April.

- 73.3% of executives indicate they expect the “same” access to capital to fund business, an increase from 53.6% last month

- 26.7% expect “less” access to capital, a decrease from 46.4% the previous month.

When asked, 16.7% of the executives report they expect to hire more employees over the next four months, an increase from 6.9% in April.

- 60% expect no change in headcount over the next four months, a decrease from 69% last month

- 23.3% expect to hire fewer employees, down from 24.1% the previous month

None of the leadership evaluate the current U.S. economy as “excellent,” unchanged from the previous month.

- 10% of the leadership evaluate the current U.S. economy as “fair,” up from none in April

- 90% evaluate it as “poor,” down from 100% last month

Twenty percent of the survey respondents believe that U.S. economic conditions will get “better” over the next six months, a decrease from 27.6% in April.

- 30% indicate they believe the U.S. economy will “stay the same” over the next six months, an increase from 6.9% last month

- 50% believe economic conditions in the U.S. will worsen over the next six months, down from 65.5% the previous month

In May, 23.3% of respondents indicate they believe their company will increase spending on business development activities during the next six months, an increase from 17.2% last month.

- 33.3% believe there will be “no change” in business development spending, down from 48.3% in April

- 43.3% believe there will be a decrease in spending, an increase from 34.5% last month

“The actions by Congress and the Federal Reserve have gone a long way to increasing confidence in our economy and financial markets. This will be a long road, with losers and winners, and only time will tell how our economy and way of life is changed after this health crisis is resolved,” says Bruce J. Winter, President, FSG Capital, Inc.

“We focus on understanding how the critical use/revenue generating assets we lend against generate cash flow for our borrowers. A deeper understanding of the borrower's business helps correlate the collateral and credit risk with the ability to repay. These fundamentals won't change in the medium or long term but, to a certain degree, the current short-term impacts of COVID-19 cannot be mitigated in certain industries. To manage a diversified portfolio, we believe working with borrowers to fully understand how COVID-19 is currently impacting their business and may change their business going forward will be key to mitigating potential loss and recovery going forward,” says Aaron Foglesong, Managing Director, Indigo Direct Lending, LLC.

“In the short term, our focus is to help the recovery of clients by providing reasonable payment relief. In the medium term we will focus on staying firm on term, structures, marketable pricing, etc., so that our industry credit and business guidelines do not become inverted (too aggressive). In the long term we need to be prepared for service industries that will go through significant consolidation or contraction due to those smaller to mid-size clients who were not able to recover,” says Michael Urquhart, President and CEO, People’s Capital and Leasing Corp.

To participate in the COVID-19 Impact Survey of the Equipment Finance Industry: Survey responses are limited to one per company. If you did not receive a survey and would like to participate, please contact Stephanie Fisher, [email protected], by May 31 to determine eligibility for inclusion in the June survey.