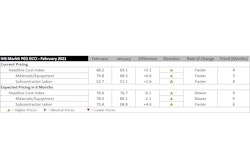

Engineering and Construction costs rose for the second consecutive month in December, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 61.0 this month.

After showing falling prices for the past nine months, the materials and equipment portion of the index finally moved into growth territory — reflecting market optimism surrounding COVID-19 vaccine distribution. The materials and equipment sub-index reached 63.4, indicative of a broader acknowledgement of higher prices. The sub-contractor portion also rose above 50, to 55.4, indicating respondents are seeing rising costs in this category as well.

For the materials and equipment sub-index, nine out of 12 components had rising prices, while respondents reported no price decreases with three categories reporting flat pricing. This was a stark change from last month when seven categories within the materials and equipment sub-index had falling prices and only five had increasing prices.

Copper-based wire and cable continued its upward month-to-month price trajectory with the highest index score for December of 82.1.

John Mothersole, director of pricing and purchasing research, IHS Markit said, “Copper has enjoyed a good run since the end of the first quarter, with the LME price rising more than 60 percent, cracking $7,750 per metric ton in December. Strong mainland Chinese consumption and South American mine supply disruptions have provided fundamental support with investor buying, adding momentum.

“Looking forward, we do not see prices holding above $7,300 per metric in 2021 as this market is now overbought and exposed to a correction. Profit taking by investors, softness in consumption this winter outside of China and a gradual end to mine disruptions set this market up for a modest retrenchment in the first half of 2021.”

The sub-index for current subcontractor labor costs came in at 55.4 in December. Labor costs were higher across most regions in the U.S. and Canada. The sub-index for Eastern Canada was the sole reporter of flat prices.

The six-month headline expectations for future construction costs index surpassed the 50-point mark once again this month; however, December’s reading of 75.1 was lower than November’s total of 78.1 — indicating price increases were not as widespread in December. Both the materials and equipment sub-index and the labor sub-index recorded expectations of future price increases.

The six-month materials and equipment expectations index came in at 76.4 with respondents expecting price growth in all categories. The six-month expectations index for sub-contractor labor recorded a total of 72.2 in December with an expectation of higher costs across the United States and Canada.

In the survey comments, respondents demonstrate optimism for the near term with little worry of shortages — either for inputs or labor.