Construction input prices increased 1.4% in November compared to the previous month, according to an Associated Builders and Contractors (ABC) analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices also increased 1.4% for the month.

Construction input prices are up 23.5% from a year ago, while nonresidential construction input prices rose 24.5% over that span. All three energy subcategories increased significantly. Natural gas prices were up 150.6% compared to last year, while crude petroleum and unprocessed energy materials prices increased 115.2% and 113.6%, respectively. Prices also rose rapidly in the steel mill products (+141.6%) and iron and steel (105.1%) subcategories over the past year.

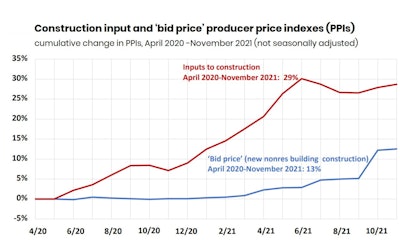

Analysis by the Associated General Contractors of America (AGC) showed increases in the producer price index for inputs to new nonresidential construction dwarfed the rise in the price index for new nonresidential construction – a measure of what contractors say they would charge to erect five types of nonresidential buildings. That index climbed by 0.3 percent for the month and 12.4 percent from a year earlier.

“Contractors are not the only people who should be concerned by today’s inflation figures,” said ABC Chief Economist Anirban Basu. “While contractors and the project owners they serve are most directly impacted by large, ongoing increases in materials prices, there are many other affected stakeholders. Among these are America’s taxpayers. Many are delighted by the passage of a consequential infrastructure package in November, yet rising materials prices mean that Americans may receive less value for each dollar spent. Rising labor costs point in the same direction.”

AGC Chief Economist Ken Simonson points out double-digit percentage increases in price indices over the past 12 months for a wide range of common construction products:

- aluminum mill shapes jumped 41.1%

- copper and brass mill shapes rose 37.8%

- plastic construction products climbed by 32.5%

- gypsum products such as wallboard rose 20.9%

- insulation costs increased 17.4%

- trucking costs climbed 16.3%

- asphalt felts and coatings are up 16.3%

- architectural coatings increased 12.4%

- lumber and plywood rose 12.2%

- diesel fuel soared 81.0%

“Prices for nearly every type of construction material are rising at runaway rates,” said Simonson. “These costs are compounding the difficulties contractors are experiencing from long lead times for production, gridlocked supply chains, and record numbers of job openings.”

“There is no indication that materials prices will fall in the near future," adds Basu. “With the omicron variant now circulating around the world and leading to a next wave of lockdowns and supply chain disruptions, demand for key commodities will continue to exceed supply. Among the implications is that estimators will be under enormous pressure to predict materials prices amid enormous volatility and uncertainty. Many ABC members expect profit margins to decline over the next several months, according to ABC’s Construction Confidence Index, and today’s data release makes that more likely.”

AGC officials said the steep rise in materials prices shows that more needs to be done to tackle supply chain issues and price inflation that are making it difficult for contractors to be successful. They urged public officials to look at ways to temporarily increase capacity at backed up ports like Los Angeles/Long Beach, abandon plans to double tariffs on Canadian wood, and address rising levels of inflation.