The Congressional Budget Office (CBO) released their analysis of the $1.2 trillion bipartisan infrastructure package and projected that the senate’s bill would add more than $250 billion to the federal deficit over the next decade. The report confirmed suspicions of Republicans that the sprawling legislation would not fully pay for itself.

The CBO projected the spending measure would add $256 billion to the federal deficit over the next decade. The bill would increase discretionary spending by $415 billion over 10 years while increasing revenues by $50 billion and decreasing direct spending by $110 billion.

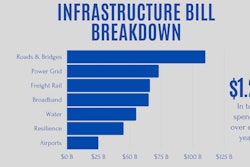

The analysis from Congress’s official scorekeeper shows that about half of the proposed $550 billion in new spending on roads, bridges and broadband would be financed by adding to the nation’s debt. The findings could give pause to some Republicans who have been leery of raising taxes or adding deficits but have agreed to support the legislation.

An estimate from the nonpartisan Congressional Budget Office was one of the last major obstacles for the legislation although Senators don’t expect a significant drop-off in support now that the CBO score has been officially released. Despite the projection, the bill is likely to still have the sufficient backing needed to pass by the end of the weekend. To pass, the bill needs 60 votes, 10 coming from republicans. The Hill is projecting the legislation may have the support of up to 20 Republicans.

What Are the Pay-Fors?

Figuring out how to finance the legislation had been one of the most fraught debates while negotiating the bill, after Republicans ruled out raising taxes and undoing elements of the 2017 tax law and Democrats balked at increasing fees for drivers According to the Associated Press, here’s a breakdown of pay-fors in a Republican summary of the plan:

- Tapping about $205 billion in unspent COVID-19 relief aid. Congress has provided about $4.7 trillion in emergency assistance in response to the pandemic.

- Drawing on about $53 billion in unemployment insurance aid that the federal government was providing to supplement state unemployment insurance. Dozens of states are declining to take the federal supplement

- Drawing on about $49 billion by further delaying a Medicare rule giving beneficiaries rebates that now go to insurers and middlemen called pharmacy benefit managers. The trade association for drug manufacturers argued that the rule would help reduce patients’ out-of-pocket costs, but the Congressional Budget Office had projected that it would increase taxpayer costs by $177 billion over 10 years.

- Raising an estimated $87 billion in spectrum auctions for 5G services.

- Restarting a tax on chemical manufacturers that had expired in 1995, raising about $13 billion. The money had been used to help fund the cleanup of Superfund sites. Also, selling oil from the Strategic Petroleum Reserve would add about $6 billion.

- Strengthening tax enforcement when it comes to crypto currencies, raising about $28 billion.

- Relying on projected economic growth from the investments to bring in about $56 billion.

Finding ways to pay for these investments is paramount to Republican support as they have been expressing growing concerns about the cost of the Biden administration’s economic agenda. The C.B.O. said in a separate report that was unrelated to the infrastructure legislation, that it projected the federal budget deficit will hit $3 trillion this year and average $1.2 trillion per year through 2031.