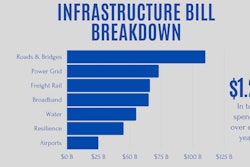

As the House is set to vote on the Infrastructure Investment and Jobs Act (IIJA) by September 27, some officials at the state level are raising concerns about the vehicle miles traveled (VMT) or road usage charges (RUC) pilot program that is laid out in the current text of the IIJA bill. Couple that with the fact the Highway Trust Fund is at a critically low level of funds and projected to run out of money by early November, lawmakers are trying to find effective ways to replenish the shortcomings.

Opponents to the pilot program view it as a step towards instituting a permanent, more expensive replacement for the gas tax. In California, the legislature passed SB-339, a road usage charge pilot program. The bill would extend the operation to study RUC alternative to the gas tax and other provision until January 1, 2027.

Sen. Pat Bates (R-CA) voted against this extension. “California has the highest gas tax and gas prices in the country, so the last thing the Legislature should be doing is laying the groundwork for charging drivers with a new mileage tax,” said Bates. “Such a tax will hurt Californians with middle and lower incomes, who tend to drive less efficient cars and live farther away from their jobs."

Is a Vehicle Mileage Tax on the Horizon?

Cost Criticism

Fuel taxes are relatively easy to administer, diesel and gasoline is not elastic, typically costing less than 1% of revenue. On the other hand, mileage fees could involve collecting taxes from millions of drivers, creating a more complex process.

RAND, a nonprofit that improves policy and decisionmaking through research and analysis, conducted a study about mileage-based user fees for transportation funding. The study found "evidence and modeling suggests that for a well-run state-level system under which most drivers pay mileage fees, costs as a share of revenue could fall in the range of 5 or 6 percent."

In another study from American Transportation Research Institute, a national VMT program could cost $20 billion annually, 300 times more than the current federal fuel tax.

Cost concerns for consumers based on travel isn't the only challenge to overcome. Implementing a nationwide program, installing some type of technology in all personal and commercial cars and trucks could rack up the price tag.

A small county straight West of Greenville, SC, recently voted to raise taxes on some property owners to replace a road user fee.

Originally covered by Greenville News, an owner of a $200,000 house who has three vehicles, would pay about $64 more in mileage but would save $60 from the vehicle fee so the owner would pay about $4 more, according to county figures read by council members. In turn, the road user fee in SC "raised around $2 million a year and the replacement would raise around $6 million dedicated to road maintenance and road work."

Additional Research and Development

Before forming an opinion about VMT or RUC, officials should discuss research and development surrounding this issue. In fact, a specific section in the IIJA creates the framework for strategic innovation for revenue collection.

The bill calls for $15 million each fiscal year, 2022 through 2026 to be used for pilot projects and participation is voluntary for any private, personal vehicle, commercial vehicle operator or owner of a fleet.

Through these pilot program, privacy concerns, cost challenges and consumer acceptance challenges should be addressed. Pete Buttigieg, U.S. Secretary of Transportation and the Secretary of the Treasury are spearheading this initiative. In the coming weeks and months, ForConstructionPros.com should have more information about the Infrastructure Investment and Jobs Act along with other pertinent information related to infrastructure. Bookmark this page to stay on-top of the current pulse of Washington.