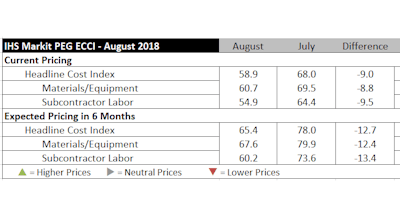

Construction costs increased for the 22nd straight month in August, according to IHS Markit and the Procurement Executives Group (PEG). The current headline IHS Markit PEG Engineering and Construction Cost Index registered 58.9, 9 points lower than July, indicating prices rose at a slower pace in August compartd to July. The decline in the current headline index was due to more respondents noting unchanged prices compared to the previous month. Both materials/equipment and labor sub-indexes showed pricing increases.

Price increases for materials and equipment were weaker across the board in August; the index posted a loss of 8.8 points, falling to 60.7. The indexes were lower in 10 of the 12 categories, though 11 of 12 were above the neutral threshold of 50, with the index for turbines falling to the neutral mark of 50.0. The biggest losses were in the indexes for the three steel categories, turbines and heat exchangers. The only category that experienced faster price increases this month was ocean freight.

“Trade uncertainty continues to weigh on procurement, and the volatility in the index demonstrates the erratic effects of trade disruptions on supply chains,” said John Anton, associate director – pricing and purchasing, IHS Markit. “The pricing environment for materials and equipment is made worse by uncertain policy duration, potential company exceptions, country exemptions and the combination of tariffs and quotas. Those buying from South Korea or Brazil face delivery failure.”

Current subcontractor labor prices increased at a slower pace this month, with the index decreasing 9.5 points to 54.9, marking the 13th straight month of increasing prices. Labor costs continued to increase in Canada, the U.S. South and West. After reflecting increasing costs in the U.S. Northeast and Midwest in July, the indexes for the two regions moved to the neutral threshold of 50.0 in August.

The six-month headline expectations for construction costs index reflected expectations of increasing prices for the 24th consecutive month. However, the index fell 12.7 points to 65.4 as more respondents expected prices to stay the same. The materials/equipment index decreased 12.4 points to 67.6. Expectations for future price increases were widespread, with all material indexes remaining above 60.0. Price expectations for subcontractor labor slid 13.4 points lower, coming in at 60.2. Labor costs are expected to rise in all regions of the U.S. and Canada.

In the survey comments, respondents indicated a tight labor market for welders, electrical engineers, and manufacturers. They also continued to highlight concerns about rising prices and uncertainty stemming from developments in U.S. trade policy.

To learn more about the IHS Markit PEG Engineering and Construction Cost Index or to obtain the latest published insight, please click here.

![Fcp Racatac Chair 10893876[1]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/10/fcp-racatac-chair-108938761.10l0At5WXv.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)