The 2019 Paving 50 contractors generated $493,058,434 in paving-only sales, down only slightly from the $503 million in paving-only sales in 2017, the last time the list was comprised of 50 contractors.

We speculated last year that the decline in paving-only sales of the 2018 list to near $634 million compared to $713 million in 2016 and $875 million in 2015 (the last three years the lists contained 75 companies) likely represented “a more accurate level for this group” because paving-only sales for 2015 and 2016 “almost certainly spiked as a result of pent-up demand for the Great Recession.”

We feel the same can be said this year, with paving-only sales likely approaching a more normal level of $500 million for the 50 Top Paving contractors. Time will tell but this (and 2018’s $634 million for 75 companies) could be benchmarks for future comparisons.

Not surprisingly, paving-only sales continue to dwarf sales of other industry segments, with striping-only sales coming in a surprising second at $215 million, followed by pavement repair-only sales at $209 million, followed by sealcoating-only sales at $137 million. In 2018 pavement repair-only sales topped $265 million while striping-only sales topped $143 million – hence the surprise.

Total Sales for Paving 50

Total sales for all the work the 2019 Paving 50 did was $1,046,678,614. (Total sales the 2017 Paving 50 reported was $962,411,076 – the lowest total since we began reporting this information in 2013.) Total sales for years when the Paving Top Contractor list included 75 companies was:

- $1.342 billion in 2018

- $1.649 billion in 2016

- $1.548 billion in 2015

The 2019 paving-only sales represent 47% of total list sales, the same as 47% in 2018, up from 46% in 2016, down from 53% in 2015 and from 55% in 2014. The remaining 53% of sales come from a broad mix of other pavement maintenance services:

- 46 companies perform sealcoating work (92%)

- 43 companies perform striping (86%, though 22 of those companies generate less than 5% of sales from striping)

- 41 companies perform pavement repair work (82%)

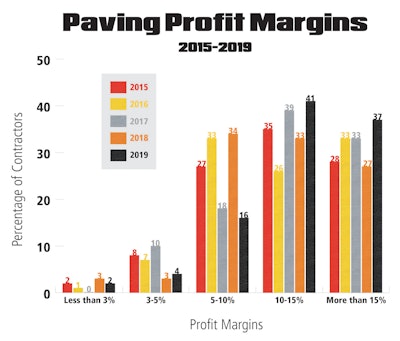

Higher Profit Margins

As the chart on this page shows, contractor profit margins within the 2019 Paving 50 shifted dramatically, particularly a large reduction in the number of contractors reporting margins in the 5-10% range and the positive shift of contractors reporting larger margins.

- The percentage of Paving 50 contractors reporting margins of greater than 15% rose to 37% from 27% last year and up from 33% in 2017 (when the list also included 50 contractors).

- The percentage of contractors reporting margins in the 10-15% range rose to 41% from 33% last year and from 39% in 2017

All this happened as contractors reporting margins in the 5-10% range declined from 34% in 2018 to 16% in 2019 (18% in 2017). So, contractors reporting margins of greater than 10% was 78% -- compared to 72% in 2017 (and 60% in 2018, 55% in 2013, 54% in 2014, 63% in 2015 and 59% in 2016.

The percentage of contractors reporting margins of 5% or less remained the same at 6%. Where Pavers Work

There’s no question that the 2019 Paving 50 emphasize off-road work, with 49 companies (98%) reporting sales from parking lots and 34 companies (68%) reporting sales from driveway paving. Still, 32 companies (64%) report sales from work on streets and 7 companies (14%) report they work on highways.

The Paving 75’s Customers

- 49 contractors work for commercial/industrial customers (98%)

- 36 contractors work for multi-family residential customers (72%)

- 40 contractors work for municipal clients (80%)

- 26 contractors work for single-family homeowners (52%)

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)