Sealcoating-only sales for the 2021 Sealcoating 75 totaled $108,935,864, compared to last year’s $161 million, and $137 million for the 2019 list. As noted in the Top Contractor overview, we believe sales numbers are slightly down, compared to last year, due to the economic uncertainty the coronavirus pandemic brought to our nation.

Just for historical purposes, the sealcoating-only sales totals for the last few years when the list included 75 companies was $171 million in 2018, $201 million in 2016, and $249 million in 2015. We have previously noted that the high-volume years of 2015 and 2016 likely are the result of pent-up demand and that sealcoating-only totals are settling into a more “normal” level since then. However, this year is was an anomaly and we are seeing lower gross sales and profit across all segment lists.

In years past, the sealcoating-only sales trailed all other industry segments. This year, sealcoating surpassed striping by a narrow margin. Listed from highest revenue per segment starts with paving-only sales at $681 million, pavement repair-only sales at $205 million, sealcoating-only sales at $108 million followed by striping-only sales sitting at $99 million.

Total Sales for the Sealcoating 75

Total sales for all work completed by the 2021 sealcoating 75 was $930,805,506, which is less than what the gross sales were in the 2020 list, $1.271 billion, but right on par with what was reported in 2019, $977 million.

Sealcoating-only sales represents 24% of total sealcoating 75 sales, up from 13% in 2020. The remaining sales represent a broad mix of pavement maintenance-related work, including:

- 65 companies perform paving work

- 52 companies perform pavement repair work

- 42 companies perform striping work

None of the 75 companies on the list performs only sealcoating (three generate 95% of sales from sealcoating) and only five of the companies generate 75% or more of sales from sealcoating.

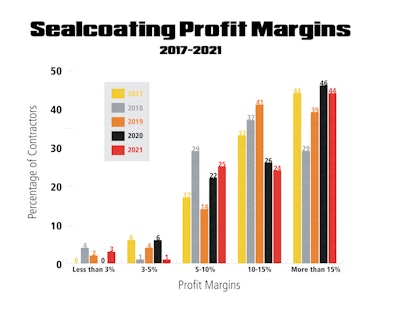

Profit Margins see Slight Drop

We have seen profit margins drop slightly across all industry segment lists compared to last year, including sealcoating. We can attribute the loss of profit

- 3% reported margins less than 3%

- 1% report margins between 3-5%

- 25% report margins of 5-10%

- 24% report margins of 10-15%

- 44% report margins of greater than 15%.

Interestingly, the middle-margin range of 5-10% saw an increase over last year (see graph for visual). We noted last year that 72% of the sealcoating list reported margins of 10% or more, but that has declined to 68% this year.

Where the Sealcoating 75 Work

Consistent with other years and with the sealcoating service, contractors on the sealcoating list emphasize off-road work, with all the companies indicating they generate sales from parking lot work; ; 8% report they generate 100% of sales from parking lots (10% last year). Another 24% report 90% or more of sales from parking lots, and 48% report sales from driveway work; 52% report they work on streets; 9% report they work on highways.

The Sealcoating 75s’ Customers

- 73 contractors work for commercial/industrial customers

- 65 contractors work for multi-family residential customers

- 52 contractors work for municipal clients

- 41 contractors work for single-family homeowners

Replacing the Sealcoating 75s’ Equipment

12 companies reported it would cost less than $500,000 to replace their equipment. Only six reported it would cost $500,000-$1 million to replace their fleet; 21 companies said it would cost $1-$2 million; and 36 companies reported it would cost more than $2 million to replace their equipment.

![Lee Boy Facility 2025 17 Use[16]](https://img.forconstructionpros.com/mindful/acbm/workspaces/default/uploads/2025/09/leeboy-facility-2025-17-use16.AbONDzEzbV.jpg?ar=16%3A9&auto=format%2Ccompress&fit=crop&h=135&q=70&w=240)