FMI Corporation considered not just the impact of COVID-19 on its new, first-quarter 2020 North American Engineering and Construction Outlook, but also high volatility across

The compiled publication offers comprehensive construction forecasts and information on key market drivers for a broad range of market segments and geographies in the U.S. and Canada.

Based on the speed and breadth of the various disruptions currently in play, FMI is anticipating, at minimum, a recession spanning the second and third quarter of 2020. Depth and reach of these disruptions will remain under watch through the coming months.

Key highlights of the report include:

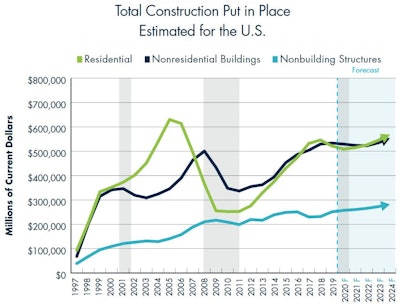

- Total engineering and construction spending for the U.S. is forecast to end down 1% in 2020, compared to 0% growth in 2019.

- Spending growth in 2020 is expected to be led by public institutional and infrastructure investments across both nonresidential buildings and nonresidential structures. Current anticipated top-performing segments forecast in 2020 include public safety (+6%), transportation (+4%), water supply (+4%) and conservation and development (+4%). Forecast bottom-performing segments in 2020 include religious (-8%), commercial (-7%), amusement and recreation (-7%) and lodging (-3%).

- Many segments were downgraded, comparing growth in 2019 and forecast growth 2020 as a result of shifting cycles within the E&C industry on top of significant recent economic disruptions. Office, transportation, power, highway and street, sewage and waste disposal, water supply, and conservation and development were all revised from “up” to “stable.” Additionally, amusement and recreation as well as manufacturing were downgraded from “stable” to “down.” Lodging was downgraded appreciably from “up” (+7%) in 2019 to “down” (-3%) in 2020.

- FMI’s second quarter 2020 Nonresidential Construction Index (NRCI) at 53.2 remains optimistic and is reflective of the strong and stable industry sentiment seen through most of the first quarter. This reading is also likely an early indication of changing sentiment due to the various economic disruptions initially realized towards the end of the first quarter.

Access the FMI North American Engineering and Construction Outlook here.