Global MEWP rental markets continued to recover strongly after the pandemic in both 2021 and early 2022, despite clouds on the horizon caused by global uncertainty around geopolitical upheavals and increased input costs, driven by rising inflation and the war in Ukraine, according to the latest analysis, conducted by Ducker.

Most markets in Europe, the U.S. and the Middle East have recovered strongly, though a resurgence of COVID-19 and accompanying lockdowns and restrictions in some parts of China hampered recovery there and caused issues in the supply of Chinese-manufactured MEWPs.The newly published Global Powered Access Rental Market Report 2022 indicates that, after a relatively slow start to the year in which many countries under study were still dealing with second and third waves of COVID, most companies in the countries under study sought to increase rental fleet size and utilization rates during 2021; post-pandemic recovery was fairly even worldwide and maintained a steady rate.

Companies returned to planned investment strategies, and supply struggled to keep up with demand in terms of new machines, especially specialist and all-electric MEWPs, owing mainly to the “whiplash” effect of the pandemic recovery on inputs such as fuel prices, energy costs and raw materials. This led to increased lead times on new machines and an increasing reliance on older or second-hand machines.

This effect continued in the first half of 2022, driven by rising global energy costs, soaring inflation in most developed economies and exacerbated in European markets by the knock-on effects of Russia’s invasion of neighboring Ukraine in February 2022.

U.S. MEWP Market

In the U.S., MEWP rental revenue increased by 15 percent across 2021 to surpass prepandemic levels, owing to the rapid reopening of nonconstruction business and pent-up demand from construction. With President Joe Biden being inaugurated in early 2021, the vaccine rollout and post-pandemic recovery stimulus were instrumental in rebuilding confidence and rebounding activity in the U.S.

As well as revenue growth (driven in part by increased rental rates, driven up by demand), MEWP fleet size in the U.S. grew by 10 percent in 2021 as rental companies resumed their prepandemic investment strategies and attempted to prevent utilization rates from increasing too quickly.

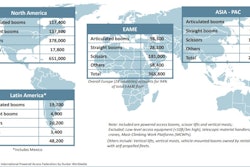

Total U.S. fleet growth was hampered slightly by supply chain disruptions, as in other western markets, though the U.S. was able to increase fleet size by more than 60,000 units to stand at 722,105 by the end of 2021. This growth is forecast to continue in 2022 but may be inhibited by inflationary pressures on the economy, as well as trade issues, including a prohibitive tariff ruling on Chinese MEWP imports announced in late 2021.

As was the case in European markets, overall fleet mix in the U.S. remained stable across 2021; scissor lifts have a slightly higher share of the overall fleet at 58 percent than in Europe (49 percent). Also as in Europe, typical power source types continued progressing toward hybrid or all-electric machines during the year, albeit at a slower pace than most European markets. In the U.S., electric booms are not as much in demand, not only because of their limited autonomy and charging infrastructure deficiencies, but also because of climatic constraints that prevent the use of electric equipment outdoors during both the colder winter and humid summer months in many parts of the U.S.

European MEWP Market

Overall, the report indicates that the European MEWP rental market did not recover quite so fully from the pandemic in 2021 as the U.S. market did, showing revenue growth of 7 percent across 2021. However, the market only recovered quite slowly in the first half of the year in most countries under study, as lockdowns and public health measures were eased at different rates in different parts of Europe.

In 2021, Europe’s rental market reached €3 billion total revenue to almost regain prepandemic levels of activity owing to recovering demand in both construction and nonconstruction sectors. Total fleet stood at approximately 325,000 units at the end of 2021. Utilization rate went up by six percentage points, driven by the post-pandemic recovery and ongoing original equipment manufacturer (OEM) MEWP shortages and supply issues. Countries such as the United Kingdom (11 percent revenue growth), Italy (12 percent) and France (13 percent) that were hit hardest in Europe during 2020 demonstrated the fastest rates of recovery.

Elsewhere in Europe, the recovery was more modest, inversely proportionate to the severity at which markets were affected in the first peaks of the pandemic: Spain and Sweden saw revenue growth in 2021 of 5 percent; Germany and Norway 3 percent; Denmark, Finland and the Netherlands all saw growth of just 2 percent.

Levels of investment grew tenfold, as rental companies resumed capital expenditure, looking for new MEWP suppliers with shorter lead times and, in some cases, receiving orders that were placed on hold or delayed during 2020. Market outlooks for 2022 remained positive, but ongoing logistics and supply chain problems caused by the pandemic, as well as the impact of war in the Ukraine on global markets and rising inflation, make forecasting increasingly difficult.

On the back of the strongest revenue growth of the European countries under study, France also recovered its position as having Europe’s largest total MEWP fleet. Germany had crept ahead of France and the United Kingdom in terms of overall fleet size at the end of 2020, but a strong year saw France increase total fleet size to more than 62,000 at the end of 2021, compared with just over 60,000 units in Germany’s fleet and 58,000 in the total United Kingdom fleet.

The transition to greener continues strongly in all European countries under study, albeit slightly hampered by issue in terms of availability of new machines. Most European rental companies expect to complete their transition to a “green” fleet in the next five to 10 years.

China and Middle East MEWP Report

As in 2021, the 2022 report also contains a special market focus on China and on the Middle East Gulf Co-operation Council countries of Saudi Arabia, UAE and Qatar. The China report paints a picture of a MEWP rental market still growing at unprecedented speeds in 2020 and 2021, despite the pandemic. Chinese MEWP rental market growth remained strong (47 percent) in 2021, driven mainly by fleet expansion. However, uncertainty around COVID-19 outbreaks in key cities in China severely limited market optimism, giving rise to only moderate growth outlooks for 2022-23, with forecast annual revenue growth of 10 percent in 2022 and 6 percent in 2023.

It remains to be seen whether China’s turbo-charged MEWP rental market can confound subdued expectations or if global economic headwinds, rising input costs, geopolitical instability and trade friction will place a brake on what has been a runaway success across the past five years.

China’s fleet size continued expanding at a remarkable rate: The estimated total MEWP rental fleet expanded rapidly in 2021, reaching almost 330,000 units in total. Total fleet size is forecast to stand around 435,000 to 440,000 at the end of 2022. After years of very rapid growth, major Chinese rental company investment is expected to stabilize gradually. More moderate, but still double-digit, fleet growth is expected from 2023 onward. Will the Chinese rental fleet one day exceed that of the U.S. at some point in the next five years? At this rate of growth, it is impossible to rule out.

The picture was also largely positive in the Middle East, with the recovery largely tracking the higher end of the European or U.S. markets. On average, across the three countries under study, revenue grew by 13 percent. This recovery came largely as a result of improved average utilization and rental rates, driven by the resumption of paused construction projects and new sources of revenue in facilities management.

Total MEWP rental revenue recovered from the lows of the pandemic in all three countries under study, with combined annual revenue reaching $146 million, driven by ongoing infrastructure investment in the region and business generated by the Dubai Expo trade fair in the fourth quarter of the year.

In 2021, the total fleet size in the three Middle East countries under study grew by around 2 percent, owing to rental companies increasing their fleets to prepandemic levels to keep pace with the recovering demand.

For 2022, respondents expect to continue buying machines, increasingly turning to Chinese MEWP manufacturers who, in the current climate of supply chain disruption, are more able to guarantee shipments than western OEMs. Fleet mix was fairly stable, with a slight increase in the share of vertical or spider-type lifts; boom-type machines are predominant in Middle Eastern fleets at just under half of the total rental fleet.

While diesel-powered booms still represent the bulk of the MEWP fleet in all three countries under study, the share of electric-powered equipment is expected to grow as end use pivots toward more facilities management.

In summary, fleet sizes and rental revenue are increasing in all markets under study, investment confidence has returned, the pivot toward electric and hybrid-powered machines continues apace and even well-documented supply-chain problems cannot dampen optimistic outlooks for the next few years. While there are undoubtedly clouds of uncertainty on the horizon, the outlook remains bright for the powered access rental industry in most developed markets for the foreseeable future.