United Rentals released their financial results for the second quarter of 2021 and raised its full-year 2021 guidance.

Matthew Flannery, CEO of United Rentals, said, “We were pleased with our second quarter results, which were in line with our expectations and reflected a continued recovery across our construction and industrial markets. I continue to be proud of the job our team does every day to safely support our customers as their activity levels rebound.”

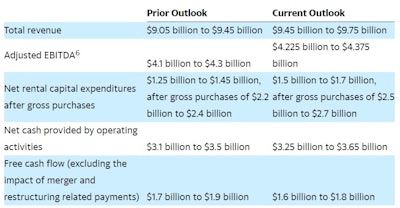

Flannery continued, “Looking forward, we remain encouraged by the gains we’ve seen in end-market indicators, including our customers’ sentiment and project visibility. We are raising our guidance to reflect the expected contribution from our recently completed acquisitions, as well as accelerated momentum in our underlying business. Combined, we believe this positions us well to deliver strong growth and returns in the second half of the year.”

Summary of Second Quarter 2021 Financial Results:

- Rental revenue for the quarter was $1.951 billion, reflecting an increase of 18.8 percent year-over-year. The increase reflects, in part, the pronounced impact of COVID-19 in the second quarter of 2020. Fleet productivity increased 17.8 percent year-over-year, primarily as a result of better fleet absorption.

- Used equipment sales in the quarter increased 10.2 percent year-over-year, reflecting a strong used equipment market. The gross margin increases were primarily due to stronger pricing, which rose sequentially for the third consecutive quarter. Used equipment proceeds in the quarter were 59 percent of original equipment cost, compared to 54 percent in the year-ago period.

- Net income for the quarter increased 38.2 percent year-over-year to $293 million, while net income margin increased 190 basis points to 12.8 percent, primarily reflecting improved rental gross margin, decreased non-rental depreciation and amortization, and a $30 million (23 percent) reduction in net interest expense due to decreases in both average debt and the average cost of debt.

- General rentals segment had a 16.8 percent year-over-year increase in rental revenue to $1.466 billion for the quarter. Rental gross margin increased by 250 basis points to 35.9 percent, primarily due to a reduction in depreciation expense as a percentage of revenue, partially offset by a higher bonus accrual and increases in certain operating expenses, including delivery costs, as a percentage of revenue.

- Specialty rentals segment (formerly Trench, Power, and Fluid Solutions) rental revenue increased 25.3 percent year-over-year to $485 million for the quarter, including $24 million from the recent acquisition of General Finance. Rental gross margin decreased by 40 basis points to 46.4 percent, due primarily to the expected dilutive impact of the General Finance acquisition.

Information provided by United Rentals and edited by Alexis Sheprak