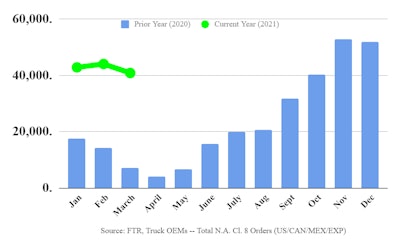

FTR reports preliminary North American Class 8 net orders for March came in at 40,800 units, a record sixth consecutive month exceeding the 40,000-unit threshold. March orders were down 9% m/m but up more than 33,000 units than the pandemic-impacted March 2020. Class 8 orders now total 372,000 units for the past 12 months.

Significantly more trucks are needed to handle the impressive freight growth generated by the economic recovery and government stimulus. However, truck production continues to be substantially limited by shortages of semiconductors and various other components. Fleets continue to order in large quantities to secure trucks for future needs.

Don Ake, vice president of commercial vehicles for FTR, says, “There is tremendous pent-up demand being generated due to the constrictions on supply. The pressure in the market is building, as orders continue to flow into OEMs at a record pace. To have this level of orders roll in for half a year is impressive and unprecedented.

“The component shortages of semiconductors and other parts are causing problems throughout trucking. Fleets desperately need many new trucks right now to keep up with demand, but production throughput is being constricted. It appears the industry will be playing catch-up well into the first half of next year.

“There are no clear indications of when the supply-chain issues will be resolved. We expect computer chips to be in short supply for at least a few more months. Worker shortages at key suppliers should get alleviated some by the vaccines. The backup at the ports will also take a few months to resolve.”