Infrastructure In America

To date across the Biden-Harris Administration, more than 40,000 projects are moving forward thanks to funding from the bipartisan infrastructure law. However, there are lessons to be learned from the current spending bill. As we see the end of this historic bill in sight, it is time to really start figuring out where the asphalt and road building industry should be putting their collective influence to best use.

IJA created 452 different funding buckets which feeds those tens of thousands of projects completed or currently underway nationwide. Over half of the 5,532 competitive awards have been for less than $1 million, and another 29% fall between $1 - $10 million. The positive effects of the law will continue to be felt for years to come.

It's hard to overstate how revolutionary that is, because it feels like we've been talking about it for so long. But these monies actually made it down to the local and municipal levels of infrastructure. Bridge repairs, safer streets and neighborhood initiatives, and so much more, all the way up to lane expansions for congested highways in smaller market cities. If you've witnessed small sidewalk repairs happening in your local area, bad stretches of worn out roads finally getting fixed, or old pieces of infrastructure getting torn out, then you've likely witnessed IIJA funds at work in your community.

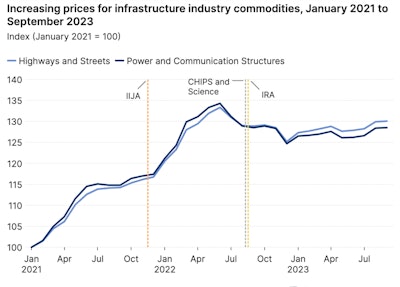

However, the final chapter of the bipartisan bill might not be as impactful as the early ones. This is because, according to the Bureau of Labor Statistics, somewhere between 31% and 40% of the remaining funds could be absorbed by inflation. That is completely without equal precedent. There is an added uncertainty with president Trump returning to the White House, there could be disruptions to the way the last days of the IIJA plays out. That doesn't just take into account direct actions against the bill, it also takes into account other factors like Trump's proposed tariffs.

Where inflation took a huge chunk of the pie out of the equation, the possible impacts of tariffs on imported goods could make matters more difficult. Tariffs are not paid by the country or foreign companies shipping goods to the United States, but are paid by the one importing the goods and usually passed on to consumers.

U.S. Bureau of Labor Statistics data

U.S. Bureau of Labor Statistics data

We are heading into the final year of the IIJA, with the hindsight you have now, what are some of the biggest successes you’ve seen delivered from this landmark piece of legislation?

Zack Fritz: While this may seem obvious, the biggest success is that infrastructure outlays have translated into actual infrastructure projects. Spending on highway and street projects, for instance, is up more than 36% since the IIJA was signed. Other infrastructure categories, like water supply (+62% over that span), have seen even larger increases. Given how the environmental review process and other legal challenges can bog these projects down, seeing dollars hit the asphalt should come as a big relief.

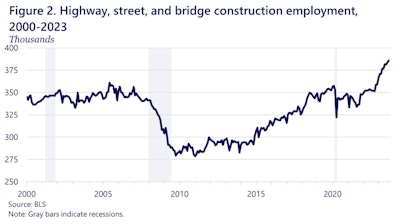

Alison Black, ARTBA: The Infrastructure Investment and Jobs Act (IIJA) continues to have a significant market impact as year four of the program gets underway. The law’s investment has helped support significant increases in major indicators, including contract awards, highway and bridge contractor employment, and construction activity. ARTBA analysis suggests that there is still a lot of IIJA funding on the horizon. Many projects supported by discretionary grants and the new formula bridge program have yet to enter the construction phase.

This impact has been amplified by states increasing their own transportation revenues in 2023, through bond issues, raising recurring revenues, new user fees, and General Fund transfers. While not many states raised transportation revenues in 2024, voters approved 77 percent of 370 funding measures on the ballot. The approved measures will generate an estimated $41.4 billion in new and renewed funding over the next few decades.

Contractors continued to be busy in 2024 – with construction activity continuing to trend upward for highways (+8% versus 2023) and bridges (+16%).

These markets are expected to continue to show growth in 2025, according to ARTBA’s market outlook, with total transportation construction activity across all modes increasing 8 percent compared to a record-level of work in 2024.

New state department of transportation (DOT) budget authority fell by two percent in FY 2025, from $215.1 billion to $210.5 billion, after two consecutive years of 12 percent growth - more than double the typical rate. However, FY 2025 budgets were up in 35 of the 48 recorded states.

The aggregate decline is primarily attributable to the recognition of major one-time appropriations out of state revenue surpluses in FY 2024, which only appear in the initial budget year but will be spent out over a much longer period

Audrey Copeland, NAPA: The success of IIJA was in setting a new standard for highway funding. At the time, we celebrated its historic nature, while cautioning that such funding levels must become the rule rather than the exception. The hurdle we face in the 119th Congress is working with many lawmakers who’ve never been involved in creating a highway bill. We must help them see IIJA as the baseline rather than a one-off.

Specific to our industry, besides the funding levels, the very necessary Buy America exemption on our construction material supply chain allowed work to proceed without undue bureaucracy, and we’re proud to have championed that effort alongside our partners in the construction materials space. Additionally, we advocated for the Work Zone Safety Contingency Fund to provide state DOTs with more funding flexibility on this critical issue. While successfully included in IIJA, we haven’t seen it take off in a meaningful way. With nearly 1,000 roadway workers suffering fatalities each year while building and maintaining our surface transportation network, we urge the USDOT and state DOTs to leverage these funds without additional delay.

What lessons have been learned from the IIJA that should be taken into account when crafting and commenting on future infrastructure legislation?

Copeland: Our focus on the next highway bill will always be how to work in the middle and strive for bipartisanship support whenever possible. That holds true for the 119th Congress. Despite differences, Congress can still get important things done. Bipartisanship is what it took to push IIJA over the finish line and that’s what will be required again, in part because of the many newly elected officials involved in what will be their first federal highway bill.

An important lesson from IIJA is that it’s critical to properly fund and focus on road infrastructure, a true highway bill, rather than making a highway bill a ‘catch all’ for other investments. IIJA provided generational investments in various public works programs like EV charging stations and rural broadband; however, with highway authorization expiring in fall 2026, that is where the focus should be – reauthorization of highway programs and sticking to core infrastructure projects. We urge lawmakers to listen to the industries that keep America moving for guidance on what it will take to maintain and improve the infrastructure that carries our shared economic prosperity.

Fritz: The IIJA dedicated more than $42 billion to increase rural broadband access through something called The Broadband Equity, Access, and Deployment Program. Thus far, exceedingly few—if any—rural households have been connected to broadband via the program, largely due to federal requirements about how affordable that internet needs to be. Policymakers should study everything about the BEAD program so they can make sure it never happens again.

Black: One important thing to understand about transportation investment is that it takes time for projects to get underway. The IIJA provided an average increase of $21.1 billion per year in increased funding levels compared to FY 2021.

About 45 percent of that incremental funding ($9.5 billion of the $21 billion increase) represents a top-up to core highway formula programs. States have decades of experience programming these funds and flexibility over the types of projects receiving obligations.

New under IIJA is a bridge formula program, which accounts for an additional $5.5 billion (26 percent) of the average annual $21 billion funding increase, and an electric vehicle (EV) formula program, which adds $1 billion (five percent) per year. Congress granted states four years to obligate funding from these programs. As a result, the pace of obligations from these programs has been slower.

Finally, the remaining $5.1 billion per year, or 24 percent of the average annual increase in funding, is controlled by the U.S. DOT and administered through a series of discretionary grant programs. This amount includes both growth in existing programs, as well as newly introduced grants.

A large share of this funding has also been slow to obligate. For example, while more than $13 billion in discretionary awards was announced during the first half of IIJA, only about $2 billion had been obligated. A primary source of this lag is the additional time often needed to reach a grant agreement, lengthened under IIJA by the rollout of new programs and learning curve for local agencies directly applying for the first time.

If you could add one thing to the future bill with the guarantee that it would be included, what would you like to see?

Fritz: While not technically part of the IIJA, I would reverse the administration’s executive order requiring project labor agreements for all Federal projects worth more than $35 million—call it addition by subtraction. PLAs drive up labor costs, meaning taxpayers get less infrastructure per dollar spent.

Copeland: We must figure out how we make the HTF financially secure, a problem that’s plagued Congress for more than two decades. If we can identify some real solutions in the next highway bill for new user fees, that would be a great step forward for future infrastructure packages. This Congress is likely the first one we can recall in modern times when a tax bill and highway bill will evolve at the same time – meaning we can work with the committees of jurisdiction simultaneously on authorizing a surface transportation bill, and paying for it, in one swoop. And unlike many industries working on tax credits and deficit risers, industries in the construction space are revenue raisers, providing options to build more resources for Congress to enact robust federal infrastructure packages.

One of the biggest issues is and continues to be, how to keep the Highway Trust Fund solvent, how to levy fees on vehicles using the roadways but not paying motor fuel taxes. Can our industry survive in a post HTF paradigm? What pathway forward do you believe most benefits our road builders?

Audrey Copeland: If we maintain current spending under IIJA without any new user fee generation, the HTF will be insolvent by 2028, and if we maintain our current outlays in IIJA without any new user fees, by the next decade we’d expect the HTF deficit to approach $250 billion. While increasing the federal fuel tax would be the simplest solution, it’s also the least likely to receive support from politicians. NAPA welcomes all possible solutions, from new programs like vehicle miles traveled (VMTs) to straightforward opportunities like capturing the electric vehicle (EV) market; VMTs have been pragmatically studied for years but have not been implemented on a large scale. Just a year ago, NAPA along with 20 coalition partners sent a letter to the House T&I Committee urging the DOT to move expeditiously on this matter.

While the sale of EVs ebbs and flows, we must recognize the importance of this market. EVs use the same roads, highways, and bridges – yet they don’t pay into the HTF at all. This is a critical oversight in our outdated user-fee funding mechanism. We must capture this market now before it gets any bigger or more politically challenging.

Neither of these solutions is a holy grail and we need to be creative on a potential myriad of options. Other promising solutions include user fee models that focus on gross vehicle registrations at the state level, project-specific public-private partnerships, and indexing the federal fuel tax for inflation.

The Election and Future Funding

We have to deal with the facts. The country will face another change in administration, as the Republican party now sits in the same position that the Democratic party did four years ago, controlling both chambers of Congress, with their executive sitting behind the desk. At present, Republicans have won 214 of the 2018 seats needed for a majority in the House of Representatives, with 18 contests still being counted.

The question for the road building industry is whether or not the GOP will have a similar focus on infrastructure investment, or does their immediate agenda lie elsewhere? With the IIJA set to expire in 2026, will the republicans use their new-found power to build on what the bipartisan infrastructure bill started?

The incoming administration will take power in 2025, just one year ahead of the expiration of the IIJA. Given this short window, would it benefit the road building industry more to continue, presumably, under a similar administrative mindset or do you think a change at the head would be better?

Copeland: The ability to craft the next highway bill may have less to do with timeframe and more to do with mindset. After a contentious election season, it’s incumbent upon everyone to set aside political differences to come to the table to hash out a highway bill that propels the American economy – because that’s what it does, that’s what we do in this industry. We are moving people and commerce to keep everything flowing.

Infrastructure has long been one of the policy pillars that largely reduces partisanship by welcoming cooperation and compromise. If Members of the 119th Congress can come together around issues that improve the daily lives of all Americans and continue to drive economic prosperity, we know they can deliver a bipartisan bill ready for signature and implementation.

It is also worth noting that the administration won’t pull every string on the next highway bill – that responsibility begins and ends with Congress – so the focus is really on elected officials in the House and Senate. That work is already under way, before the 119th Congress is even sworn in. That’s why NAPA is already working with the returning offices on highway bill priorities to establish the right priorities, right away.

Black: The 119th Congress will convene with a long to-do list, including writing a new law when the current highway and public transportation program expires on Sept. 30, 2026. Congressional hearings and other “behind the scenes” work is expected to begin in 2025. Educating lawmakers about the importance of federal transportation investment, and how projects supported by the IIJA over the last four years have benefited communities, will be important.

What political goals should the industry put its collective weight behind first and foremost?

Copeland: (1) Funding certainty for our industry and the American public – because roads and highways benefit everyone and every community across our nation. (2) Material neutrality – to allow localities and their engineers to determine what’s best to move their communities, to maximize budgets, and to minimize disruption and environmental impact. (3) Safety – for our workers, along with all road users. Our industry remains willing to work with all parties and across the aisle because roads are built for everyone, not just the people in power. We welcome the opportunity to work with the incoming administration and the 119th Congress while continuing our steadfast work with returning allies.

What political issues should the asphalt industry and road building industry be paying more attention to that sometimes go unseen?

Copeland: First, we need to recognize how many new faces will be in Washington following this election season. The influx of new Members of Congress over the last two election cycles means that more than quarter of the 119th Congress were not in office when IIJA passed in 2021. It is incumbent upon our industry and partners to educate and work with new faces across the political spectrum. If we proactively and consistently engage with our legislators, both in Washington and when they’re in their home districts, we can collectively advance our industry and our issues. Local engagement – job site visits and plant tours in each Congressional district – are especially key to demonstrating our industry’s relevance and showing lawmakers exactly how federal policy impacts their constituents. Our members are embracing those opportunities, with direct support from NAPA’s Government Affairs team.

Looking At The Record

The "Bipartisan Infrastructure Bill" what is officially called the Infrastructure Investment and Jobs Act (IIJA), and it has dominated the conversation since it's passage in the fall of 2021, during the first year of the Biden-Harris administration. It was the single largest investment into our country's roadways, public transportation, and bridges since the post World War Two era expansion of the interstate highway system.

They call it bipartisan, because, technically it did have the voting support from members of both parties in the House and the Senate. However, the vast majority of House Republicans did not vote in support of the law despite the billions in funding it secured for their home states, their Senate counterparts were more cooperative. Additionally, there were a handful of House Democrats who also did not vote for it.

The Senate voted 69-30 to pass the bill with amendment on August 10, 2021:

- All 48 Democrats voted to pass the bill.

- The two independents who caucus with Democrats also voted to pass the bill.

- 19 Republicans voted to pass the bill.

- 30 Republicans voted against the bill.

- One Republican did not vote.

The House voted 228-206 to pass the bill on November 5, 2021:

- 215 Democrats voted to pass the bill.

- 200 Republicans voted against the bill.

6 Democrats voted against the bill:

- Jamaal Bowman (D-N.Y.)

- Cori Bush (D-Mo.)

- Alexandria Ocasio-Cortez (D-N.Y.)

- Ilhan Omar (D-Minn.)

- Ayanna Pressley (D-Mass.)

- Rashida Tlaib (D-Mich.)

13 Republicans voted to pass the bill (* indicates they are no longer serving):

- Don Bacon (R-Neb.)

- Brian Fitzpatrick (R-Pa.)

- Andrew Garbarino (R-N.Y.)

- Anthony Gonzalez (R-Ohio)*

- John Katko (R-N.Y.)

- Adam Kinzinger (R-Ill.)*

- Nicole Malliotakis (R-N.Y.)

- David McKinley (R-W.Va.)*

- Tom Reed (R-N.Y.)

- Christopher H. Smith (R-N.J.)

- Fred Upton (R-Mich.)*

- Jeff Van Drew (R-N.J.)

- Don Young (R-Alaska)

Half of the House Republicans that voted for IIJA's passage were removed by their own party through primary challenges, and so it remains difficult to pin down what the current house make-up will do in regards to infrastructure. While many in both chambers of Congress who voted against the bill explained their support for infrastructure related spending, they took various issues with the bill's funding which was originally $2.6 trillion, but was eventually paired back to half that.

What Was Cut, What Wasn't, And What That Could Tell Us

In our current political era, it isn't a huge surprise to see even a popular idea like infrastructure spending become divided along party lines. With this in mind, it is possible that whatever future infrastructure spending bill that reaches Congress will pass without much difficulty since Republicans (likely at time of writing) now control both chambers. They may not need the same bipartisan support to pass their agenda.

Despite this, it's difficult to get a read on what their priorities might be in crafting new legislation. The biggest cut from IIJA was in the area of manufacturing, which was originally set to be the largest chunk of the bill at $566 billion, to get the bipartisan support, it was completely removed along with three other funding categories:

| Funding Category | Original Democratic Proposal | Bi-partisan |

| R&D manufacturing | $566 billion | $0 |

| Housing, schools, and buildings | $387 billion | $0 |

| Home- and community-based care | $400 billion | $0 |

| Clean energy tax credits | $363 billion | $0 |

While some clean energy tax incentives were included in the following Inflation Reduction Act (IRA, 2022) less than a year later, the other areas have gone mostly unaddressed. This could become a focal point of the next Republican agenda, especially given how much domestic manufacturing was touted as a priority during the campaign season. What might be more interesting and more telling than what was completely cut out, is what was left alone during the negotiation process. There were just three funding categories left untouched:

| Funding Category | Original Democratic Proposal | Bipartisan |

| Resiliency, Water Storage | $50 billion | $50 billion |

| Airports | $25 billion | $25 billion |

| Ports and Waterways | $17 billion | $17 billion |

As of the writing of this article, president-elect Trump has not released a detailed statement about the administration's goals for the first 100 days in office. According to the most recent GOP official platform and the Trump campaign materials, the top three priorities seem to be 1) Immigration reforms and the southern border, 2) Economic changes, tariffs, and tax cuts, and 3) International conflict resolutions.

However, based on the fact that in their negotiations they didn't touch these proposed budgets, could indicate that these funding categories are a serious priority that exceeds even partisanship. While even spending for roads and bridges was reduced by 28% (from $154 billion to $110 billion) these categories remained unchanged even after negotiation. There is likely a good reason for this, and the answer brings us to the next section of our report.

The State of Resiliency

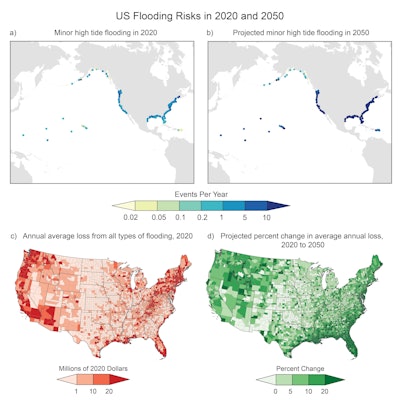

While every year sees a certain number of natural disasters taking place, knocking out roads, bridges and other infrastructure, the state of things might be a bit more concerning than just run-of-the-mill washouts. All three of the areas where the spending was left untouched deal, in one way or another, with the continued encroachment of climate change fueled catastrophes, or they exist on the periphery of the subject.

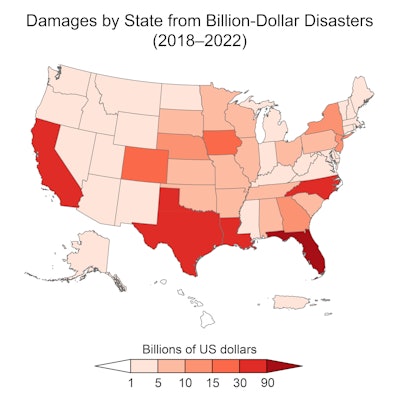

In just the last few months, the two hurricanes "Milton" and "Helene" have caused damages ranging between $51.5 and $81.5 billion combined in what one area of North Carolina described as a 1000 year storm. These increasingly costly events have brought the concept of road resiliency to the forefront, as seem by the bipartisan effort to fund it through the IIJA. However, despite this, the situation doesn't look too good for the industry, because the funding's existence has not translated to projects being awarded, which means work isn't being done.

A new study released on November 7, 2024, by the International Chamber of Commerce (ICC) called The Economic Cost of Extreme Weather Events reported that, "The number and severity of climate-related extreme weather events has risen by 83% from 1980–1999 to 2000–2019, posing significant risks to individuals, businesses and economies. This includes events such as heatwaves, extreme precipitation, droughts, and tropical cyclones. These extreme events threaten ecosystems, infrastructure, buildings and human lives, and are putting significant economic burden on countries."

Between 1980 and 2023 there were, on average, 8.5 climate-related extreme weather events per year with estimated losses exceeding $1 billion.5 In 2024, there have already been twenty-four confirmed events of this kind, and severe storms have accounted for 16 of these.6 That means we are on pace to more than triple the number of such disasters by the end of the year.

According to a Politico story written by Zack Colman and Jessie Blaeser, "Through the end of September, 80 federal programs that received $24.4 billion of the climate resilience money had awarded just $10.3 billion of it...in tentative awards among the climate resilience programs included in Politico’s analysis, to address needs such as preparing roads to withstand extreme weather, reducing flood risk and preventing wildfire."

In a statement to Politico for the story, White House chief of staff Natalie Quillian said, "All states — red, blue, purple and everywhere in between — are experiencing more frequent and severe impacts of climate change, and we are proud to have secured bipartisan legislation to help communities make long-term investments so they are protected from the harshest impacts of these events in the future," deputy White House chief of staff Natalie Quillian said in a statement."

The delays in these funds getting into the hands of climate-at-risk communities may very well translate into greater loss of infrastructure, roads, and bridges, as well as, to greater loss of life. In terms of our industry, these monies mean jobs on the front lines of where resiliency design meets real-world tests. Additionally, the incoming Trump administration has signaled to its supporters that it may roll back many of the Bipartisan Infrastructure Bill's climate policies, including resiliency funds.

Not only might this endanger already at-risk zones, but a move like that would directly pull funding away from potential government contracts for road builders. Trump campaign spokesperson Karoline Leavitt did tell Politco that the new Trump administration plans to rescind all unspent money from Biden's landmark climate law, the IRA, which included its own additional resiliency funding. However, that doesn't tell the full story.

During the first Trump administration, the president signed into law the Disaster Recovery Reform Act (2018) as part of the FAA Reauthorization Act of 2018. The law aimed to simplify some of the bureaucratic red-tape of FEMA, with 56 provisions and $25 billion in funds to aid local governments in reducing the impact of future disasters. While this law avoids anything resembling mentions of "climate change" it is essentially funding resiliency efforts.

This means it is anyone's guess what the new administration's guiding principles really are when it comes to these kinds of policies. In the past, they've been supported, but they are, at the very least, saying they intend to roll the current efforts backwards. However, there is another, third possible fate for these funds.

The Biden administration has left its official definition and guidance on the term "resilience" incredibly vague and ill-defined. This means that the incoming executive could simply redefine what the government means by the word "resiliency," and then open the door for those funds to be used in other ways the republican majority prefers. This could mean it gets to be spent on other roads or bridges, but, there's simply no way to know.

The State Of The Workforce

The real solution to the ongoing labor shortages is simple, we need more laborers. Where they are going to come from is, at least, becoming a little clearer than it has been in recent years. This is because there’s been a significant uptick in vocational school enrollment, as much as 16% from 2022-2023, and that trend continued to rise this year while enrollment in bachelor degree programs fell by 4%. Clearly, there is a generational paradigm shift underway, one that our industry can benefit from. In September, the Biden-Harris administration announced more than $244 million to help modernize, diversify and expand the Registered Apprenticeship system in growing U.S. industries. This announcement marks the largest federal investment in US history in registered apprenticeships.

Trade schools and post-secondary vocational programs are attractive for many reasons going into 2025. For many families with children reaching the age of adulthood, it offers a low-cost, low-barrier threshold to a better future, but it isn't just those who weren't top students. Even strong collegiate candidates are instead choosing the trades in greater numbers.

How would you suggest those our industry best take advantage of these trends to find new, young, and quality employee candidates to meet there staffing needs?

Copeland: This is really a local issue for every company in our industry. So it’s locally that these solutions will be identified and implemented. One example appeared on our Pave It Black podcast, featuring NAPA member C.W. Matthews. They have a program that gets training into schools and places students with different contractors across the state, establishing connections early and giving students valuable, hands-on experience. The program also incorporates technology, such as simulators, which are newer tools for training and introducing the next generation to the various opportunities our industry offers. This is just one representative example out of many across our industry for recruitment.

The construction industry labor shortfall is hovering around 500,000 people, and while that number isn't just for the asphalt industry, there's still lots of spaces that need filled.

Associated Builders and Contractors (ABC) reports that the construction industry will need to bring in 501,000 more workers on top of normal hiring to manage the construction labor shortage in 2024. Women make up a growing share of the construction employment, reaching 10.8% in 2023. This is a noticeable increase from 9.1% in 2017 and just below the record high share of 11% recorded in 2021. The median age of workers in construction is forty-two. As a new encouraging development, the share of younger workers ages 25 and under increased from 9% in 2015 to 10.8% in 2022. However, due to aging trends, the share of construction workers ages 25 to 54 decreased from 72% in 2015 to 67.3% in 2022.4

U.S. Bureau of Labor Statistics data

U.S. Bureau of Labor Statistics dataHowever, it's not all bad news. More job availability also signals that the industry is strong, growing, and well funded. For instance, from 2011 - 2019 the highway, street, and bridge construction sector added, on average, 700 new jobs a month. Since January 2021, that sector has ballooned to four times that, adding approximately 2,800 new jobs a month.

This brought the overall industry workforce back up above the pre-Great Recession high. Of course, it may not FEEL like the workforce has recovered because of all the issues with labor supply. Both things are true. There isn't always a new body to fill that new job created, so it seems like there's a shortage of workers from what everyone remembers a few years ago. But the truth is more complicated, because there are more jobs available now than there were 5-10 years ago. The overall need is greater, it's not just that there are missing workers.

What other significant needs are you hearing about that aren’t getting as much attention?

Copeland: The ongoing struggle to fill job vacancies really raises just one issue among our members, alongside the desire to steer more students toward the trades. And that’s immigration. The lack of a functional immigration system is impacting the ability of the construction industry to attract those willing to work in this field. And that’s what we’re hearing from our members – they need more, better ways to legally attract and hire qualified workers.